Table of contents

Eligibility and requirements

What is the criteria to apply for an HSBC credit card-i?

For Amanah Mpower Platinum and Amanah Mpower Credit Card-i:

- A minimum annual income of RM36,000 p.a.

For Amanah Premier World Mastercard:

- Exclusively for HSBC/HSBC Amanah Premier account/-i holder

- Primary cardholder must be at least 21 years of age; supplementary cardholder must be at least 18 years old

- A minimum annual income of RM36,000 p.a.

- Minimum RM300,000 in total relationship balance with HSBC Amanah

Credit Card-i online application

Using your new credit card-i

How do I activate my HSBC credit card-i?

You can call our 24-hour Card Activation & PIN hotline on (+603) 8321 8999 using your registered mobile number and follow these instructions.

Step 1. Press '1' for credit card/-i activation & PIN.

Step 2. Press '1' to activate credit card/-i.

Step 3. Enter the 16 digits of the credit card/-i number that you wish to activate followed by the '#' key.

Step 4. Enter the card/-i expiry date in ‘MMYY’ format.

Step 5. Enter the 6-digit OTP, which will be sent to your registered mobile number.

Step 6. Your credit card/-i will be activated within 2 hours. Please wait for the SMS confirmation before using your HSBC credit card/-i.

Step 7. If you want to activate another credit card/-i press '1', OR press '2' if you want to create the PIN (Personal Identification Number) for this activated credit card/-i.

Credit Limit Decrease

I got an SMS that says my credit card/-i's credit limit has been reduced. What is this about?

We may review your credit card/-i account(s)' credit limit from time-to-time. After we assess the credit risk associated with your credit card/-i account (including your spending or repayment/payment patterns), we may decide to increase or reduce your credit limit.

It is our responsibility to ensure that our financing products are suitable and affordable for your financial circumstances. They should not increase your financial burden.

Rewards

Am I eligible for the HSBC's Cash Back programme?

Yes, every customer with a Amanah credit card-i is eligible for the Cash Back programme.

Eligible credit cards:

- HSBC Amanah Premier World Credit Card-i

- HSBC Amanah Mpower Platinum Credit card-i

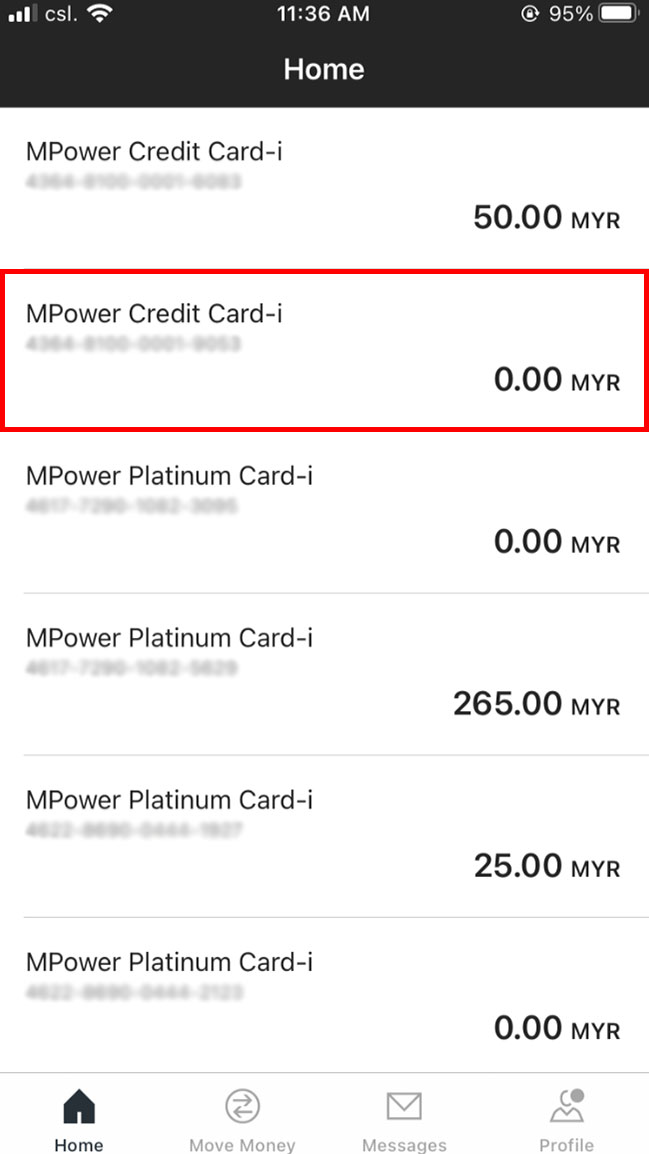

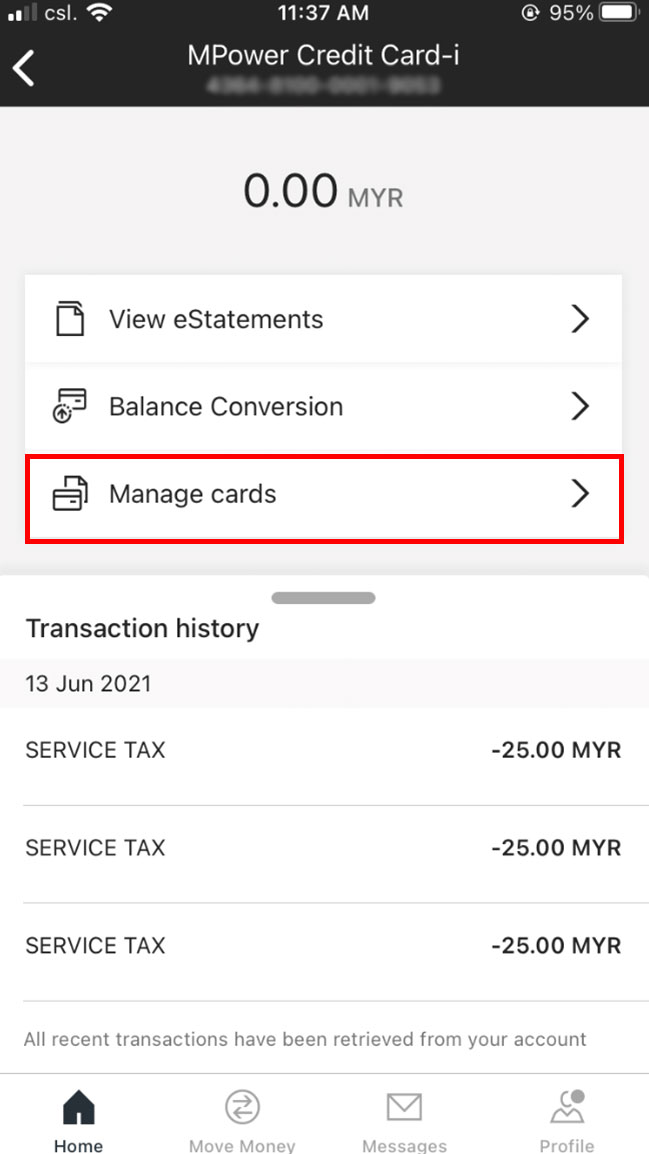

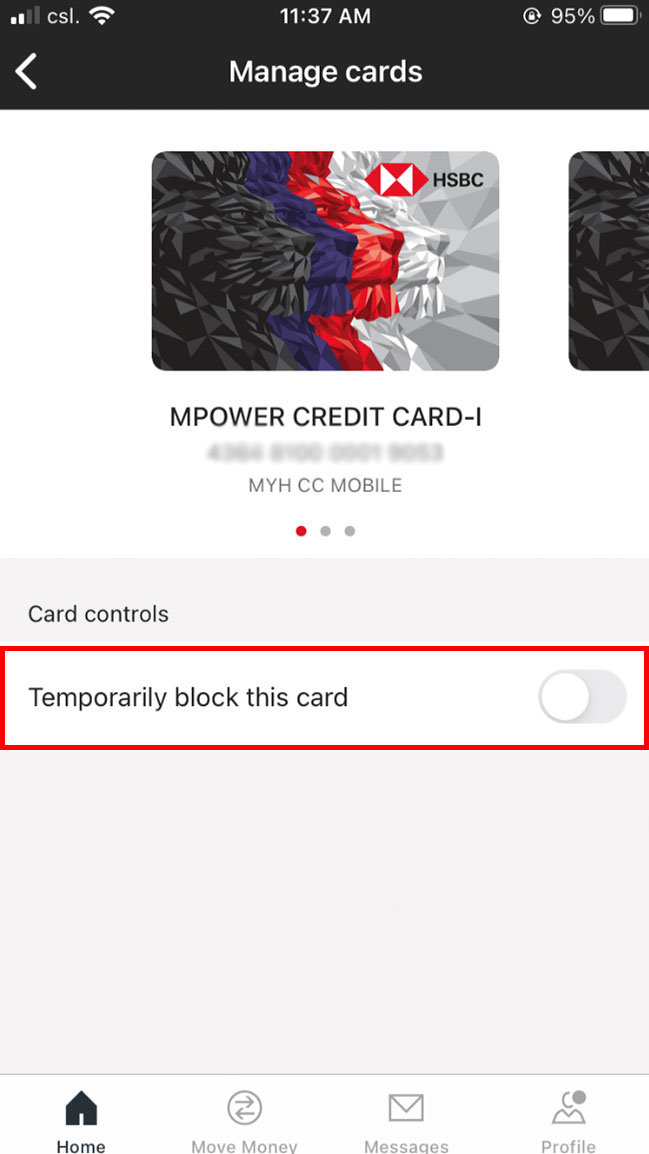

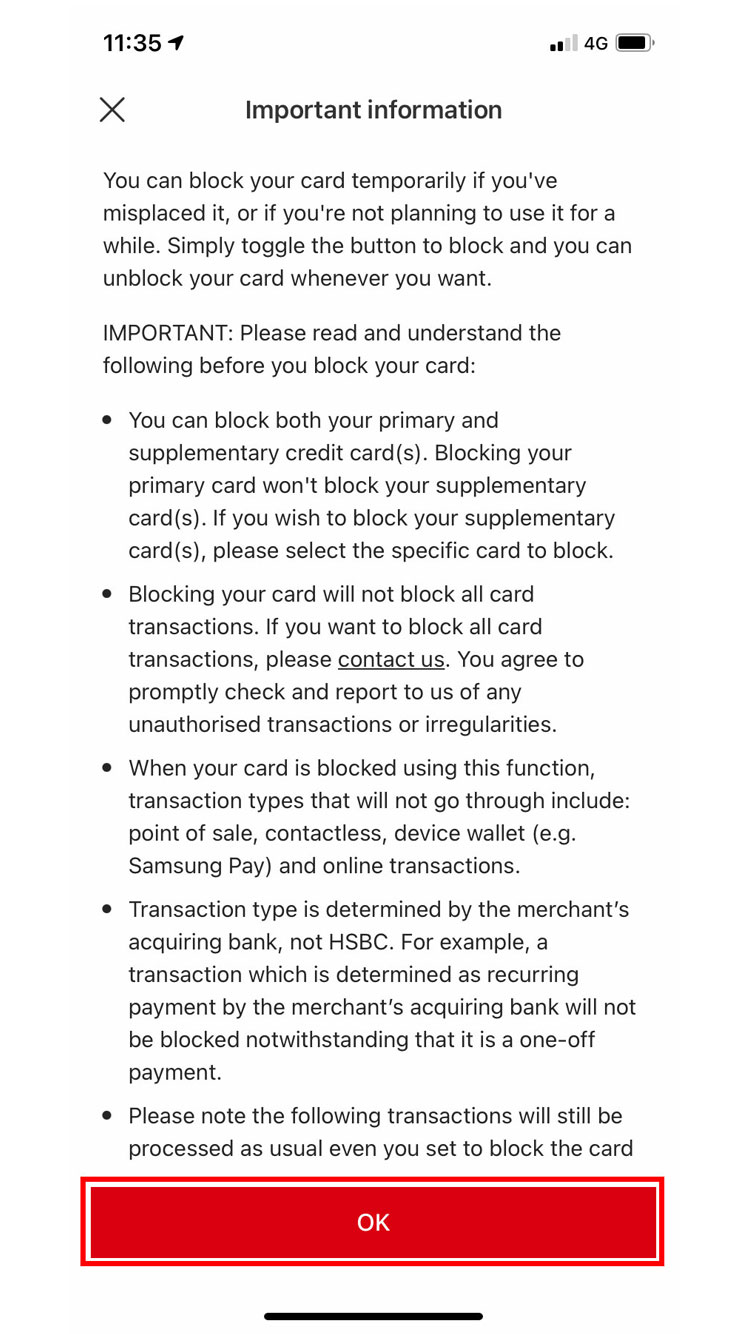

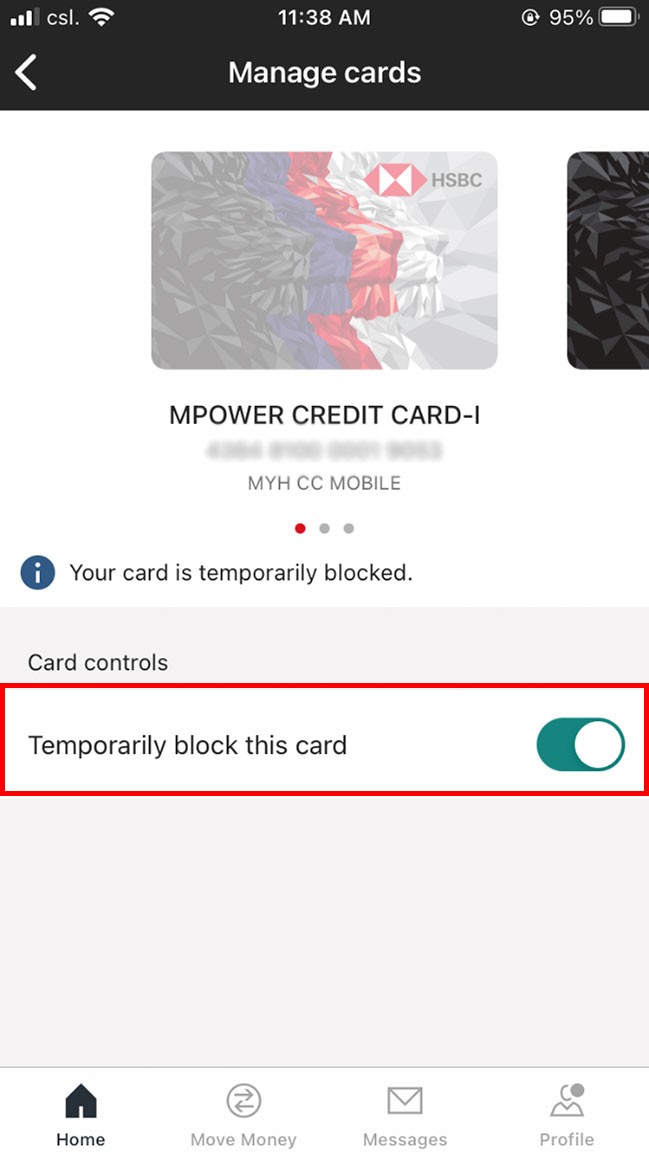

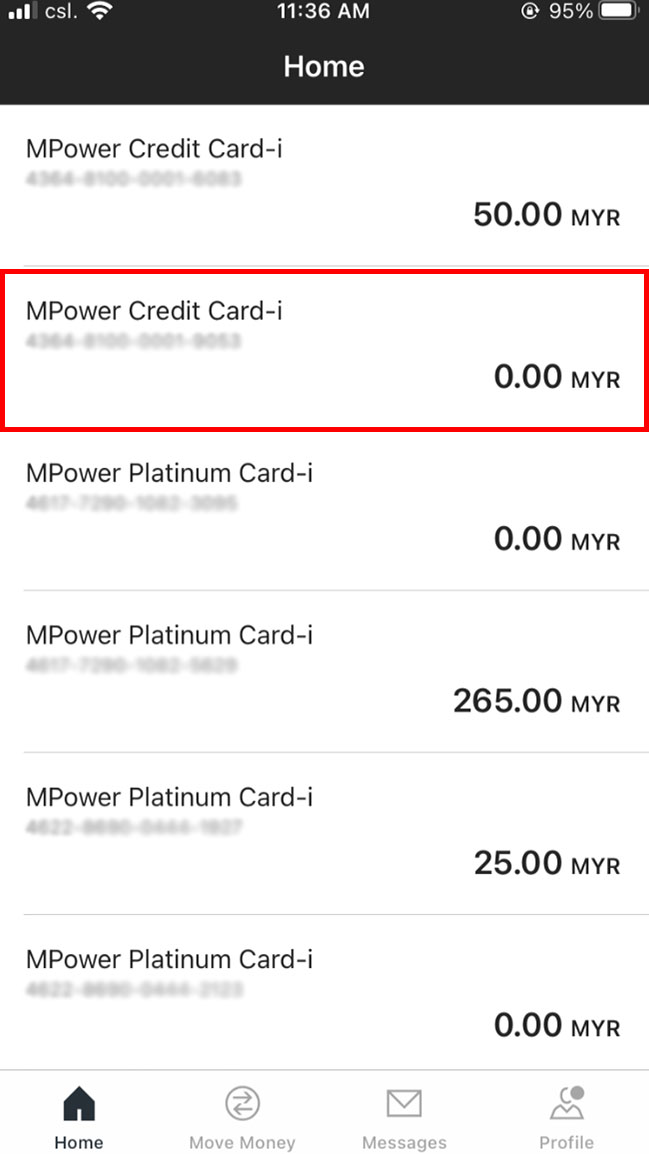

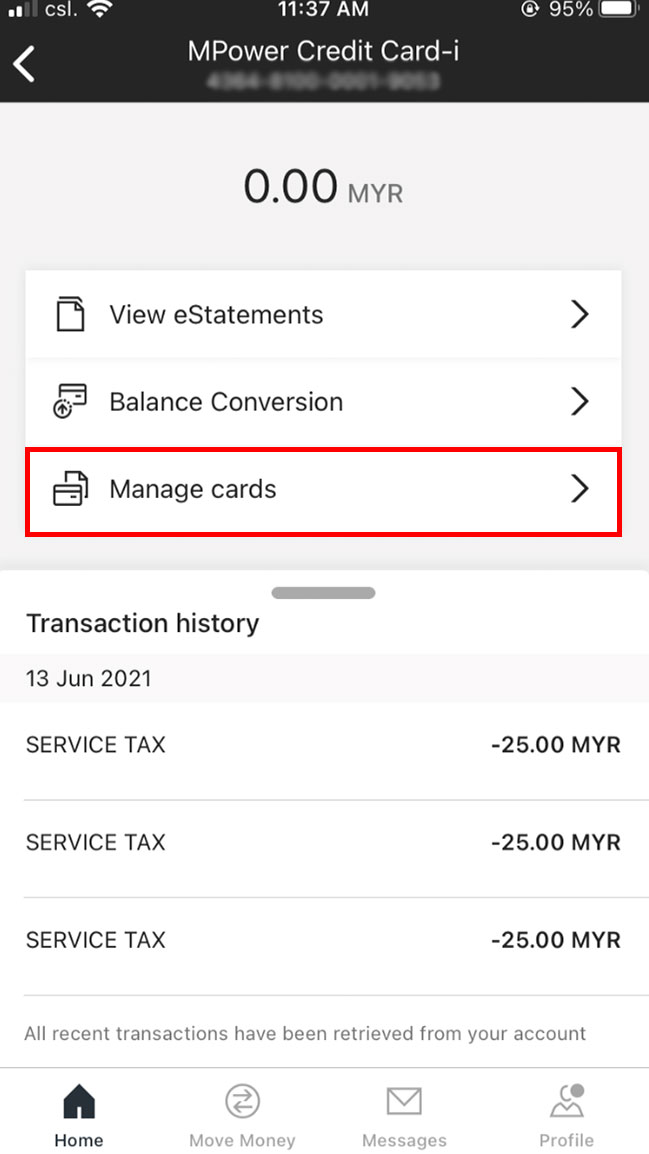

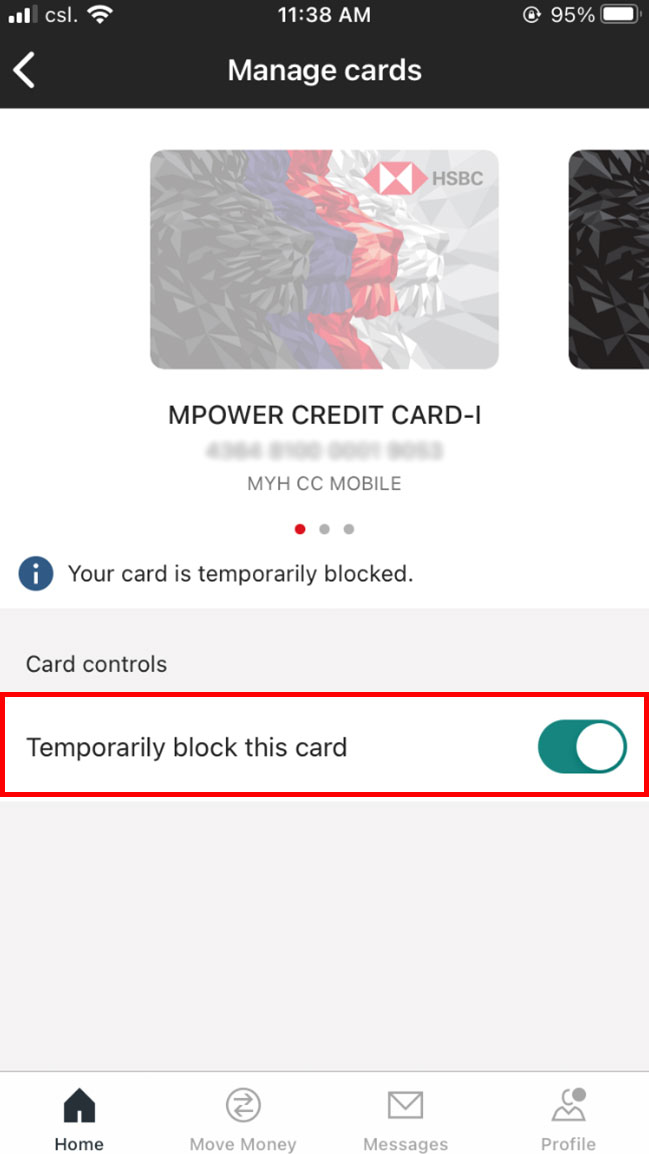

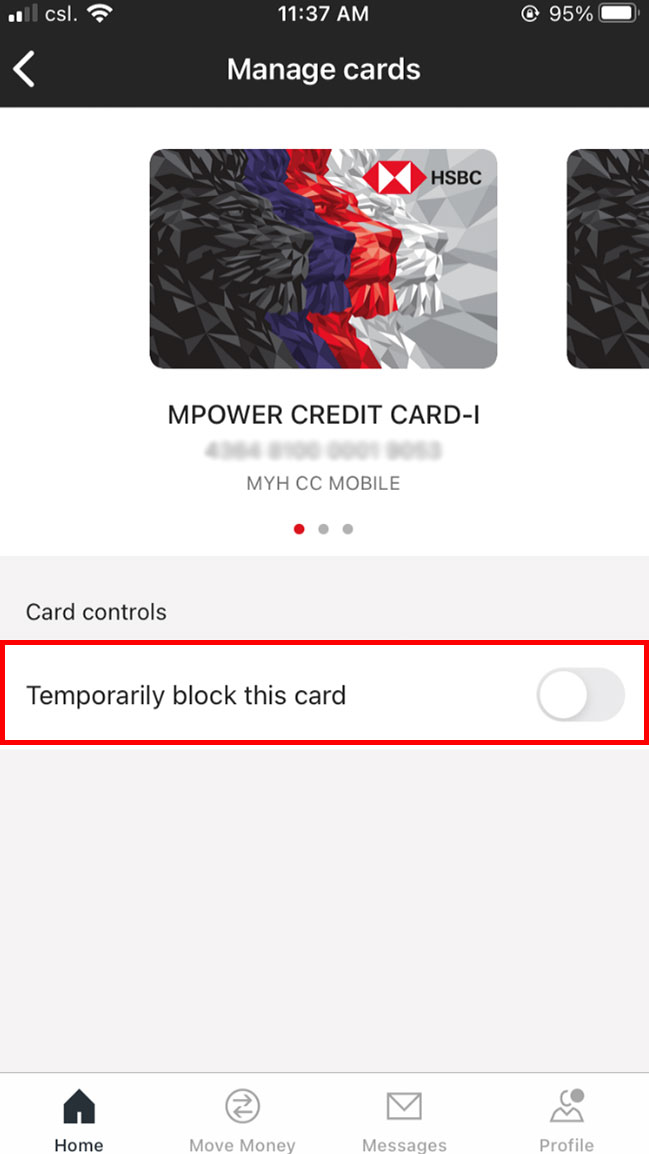

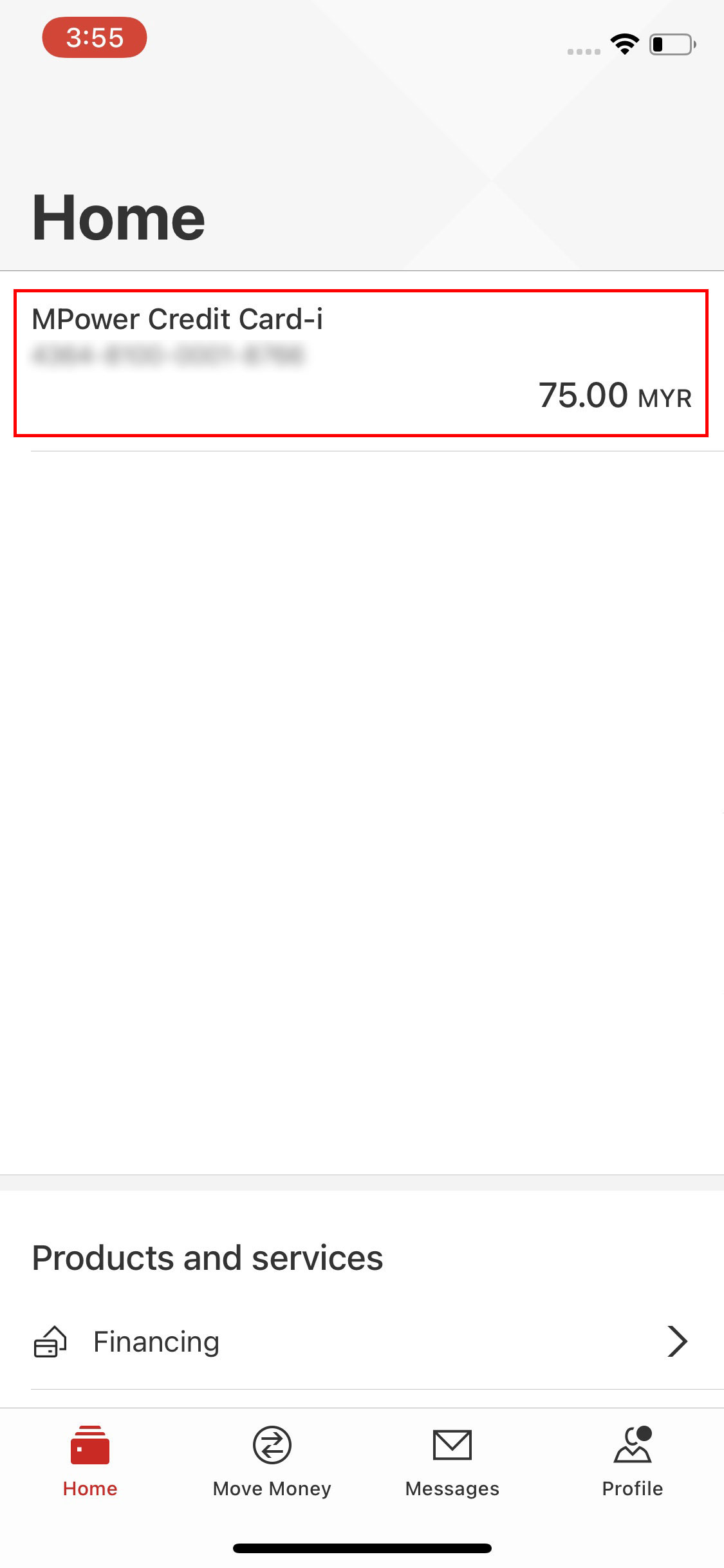

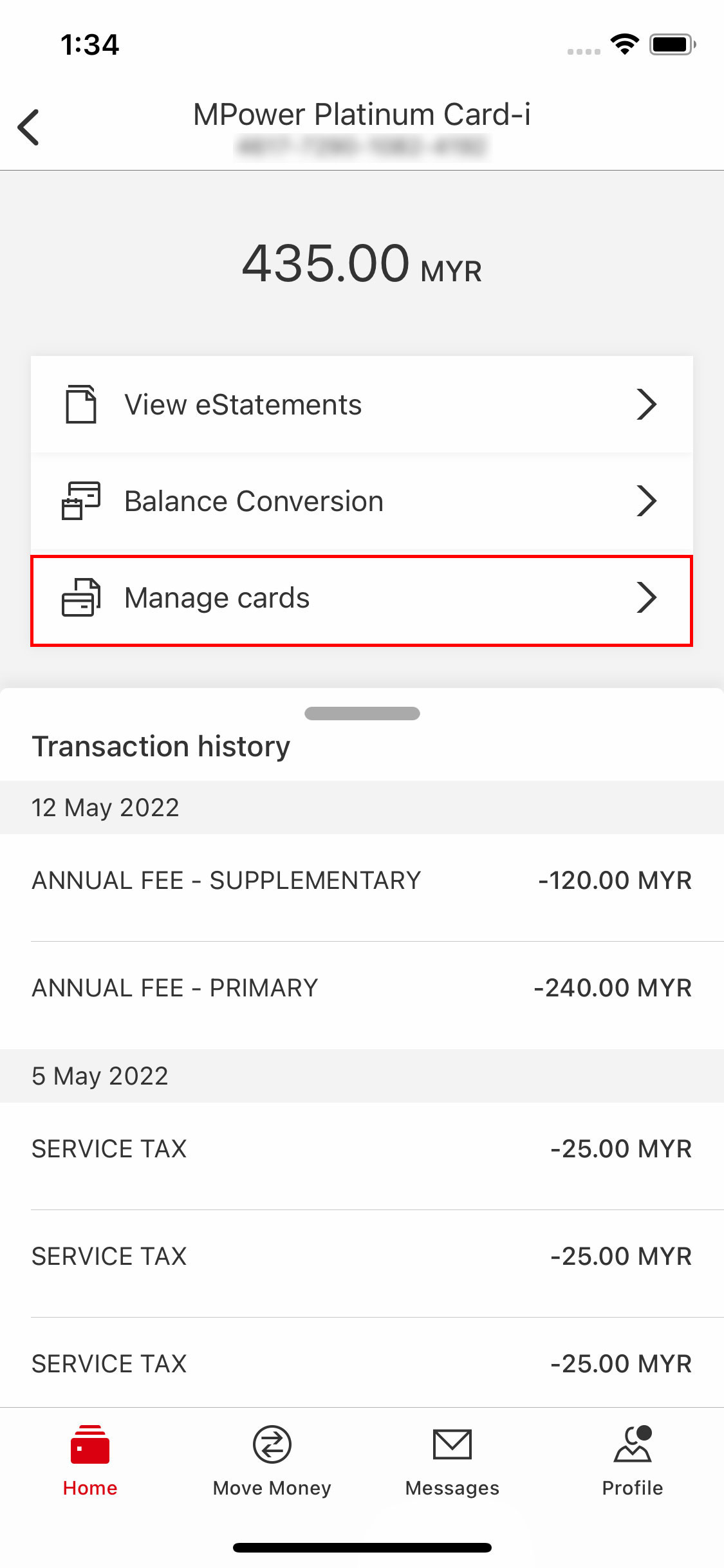

Block and unblock feature

Temporarily block or unblock your credit card-i if it's lost or misplaced directly through the HSBC Malaysia Mobile Banking app.

You'll need access to your credit card-i account in Mobile Banking to use this feature. If you have yet signed up, you can register for Mobile Banking here.

Important to note:

Using this feature won't permanently block your card. If your credit card-i is lost or stolen, please report it immediately by calling 1300 80 2626 (Local) or +603 8321 5200 (International), or contact us another way.

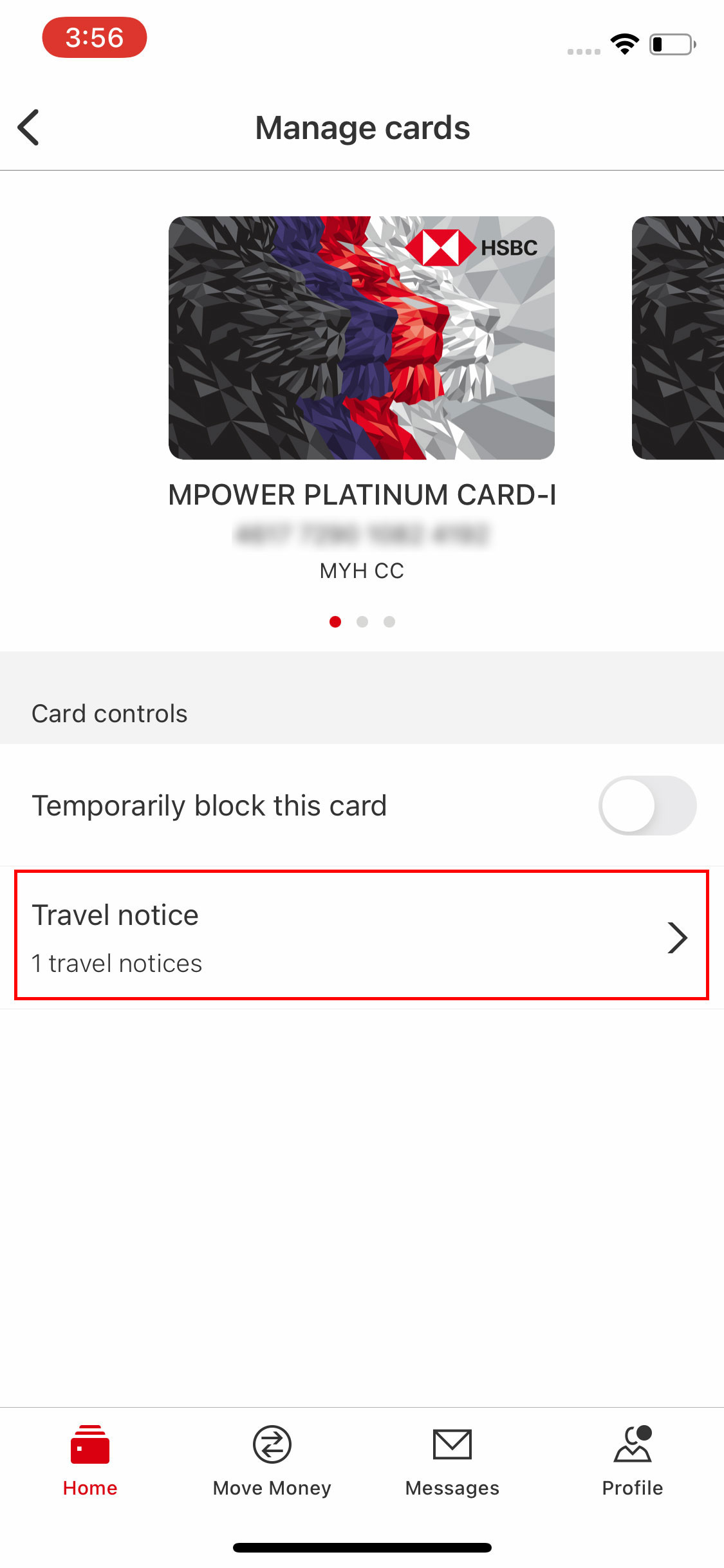

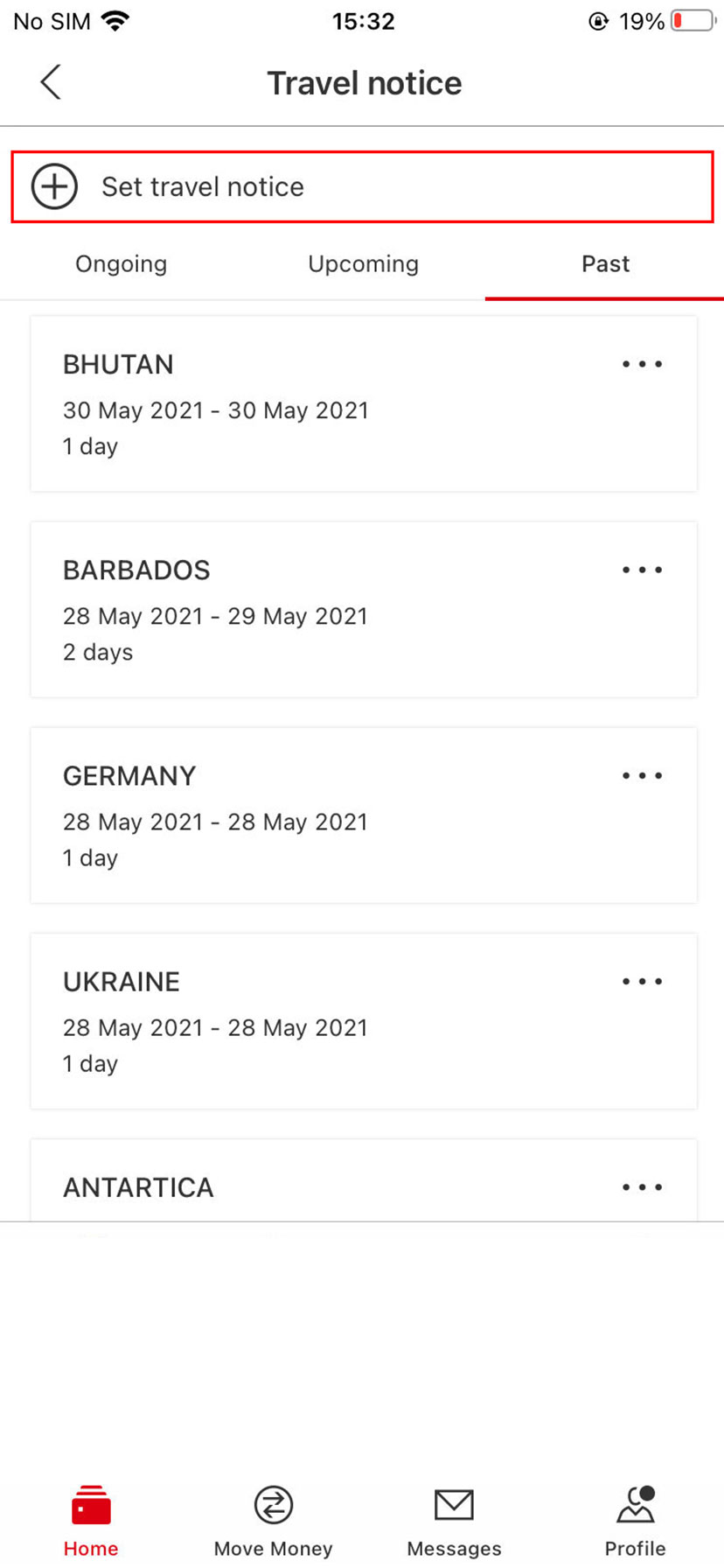

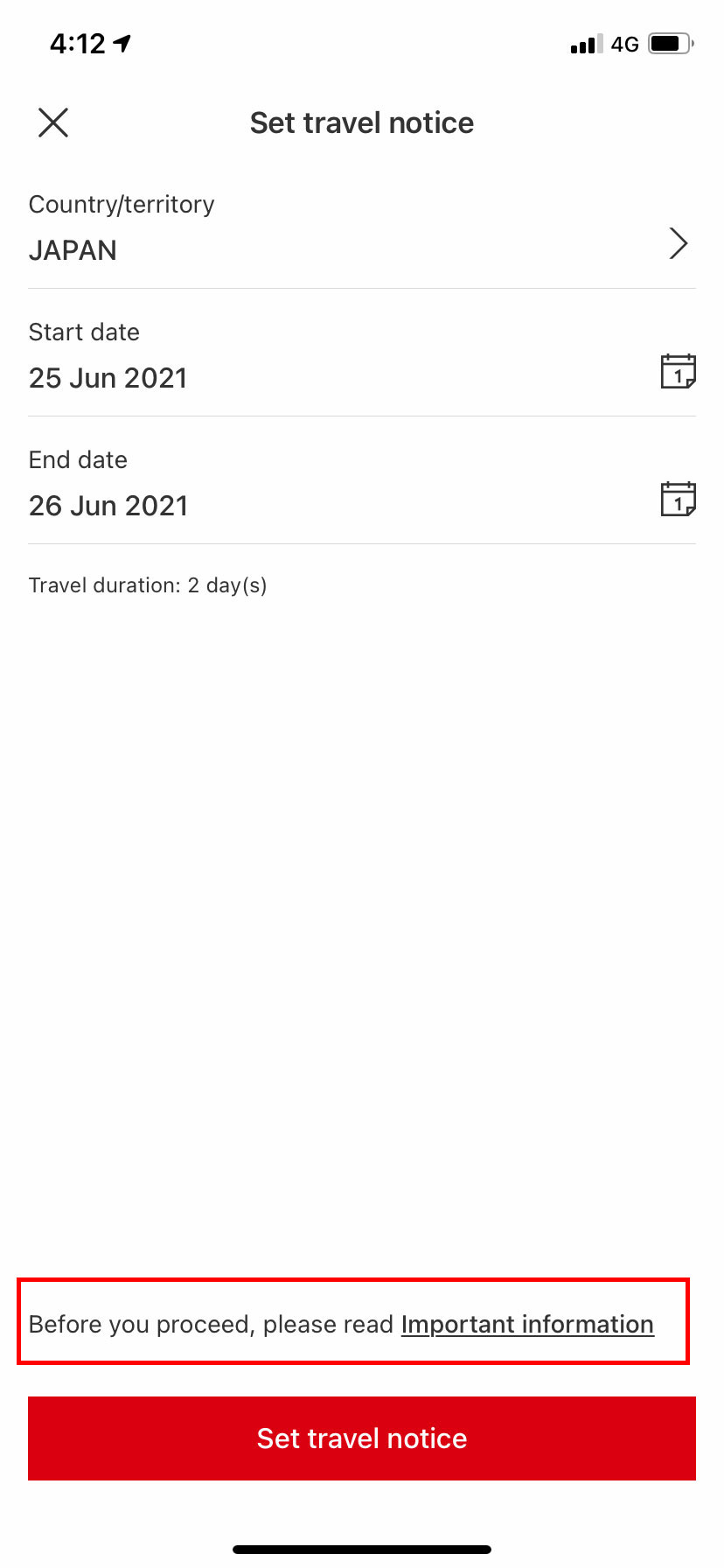

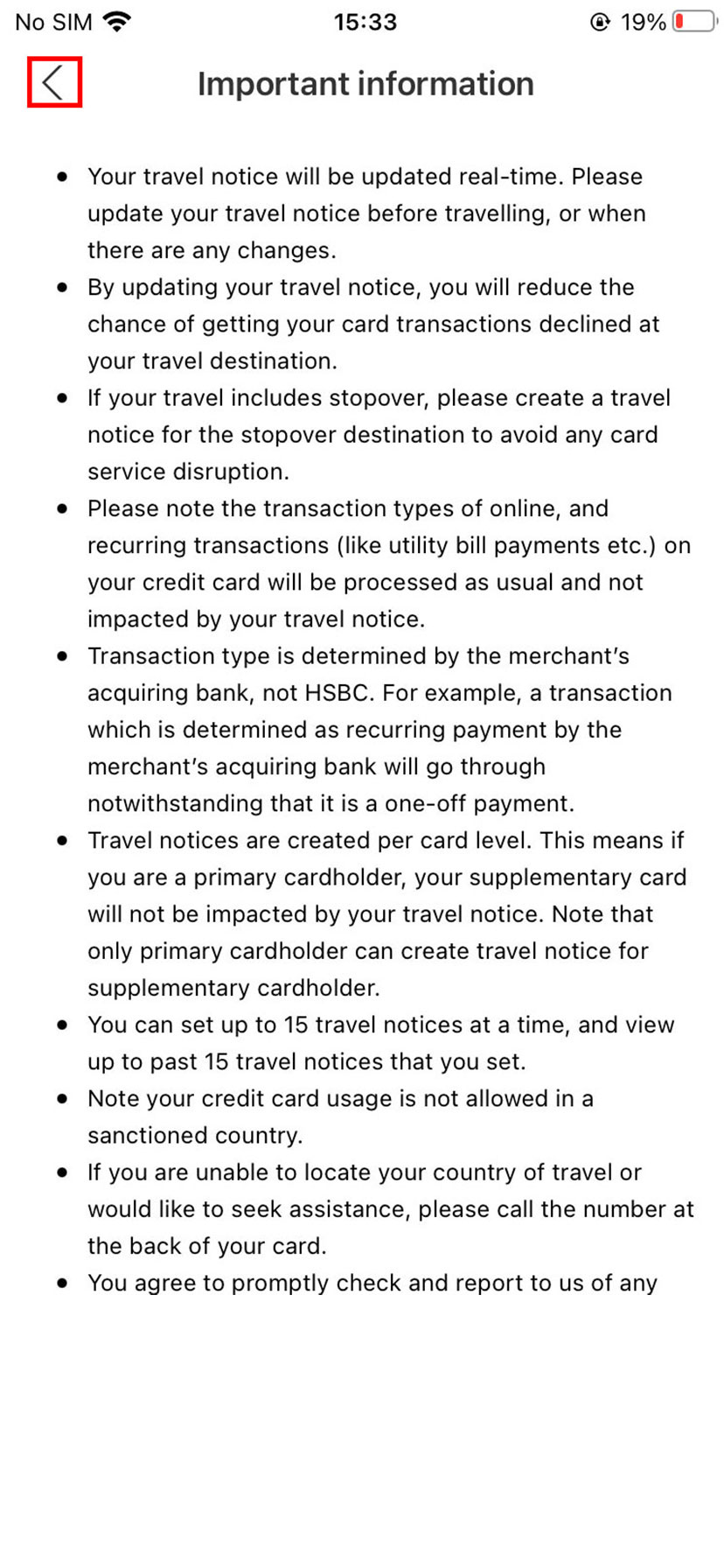

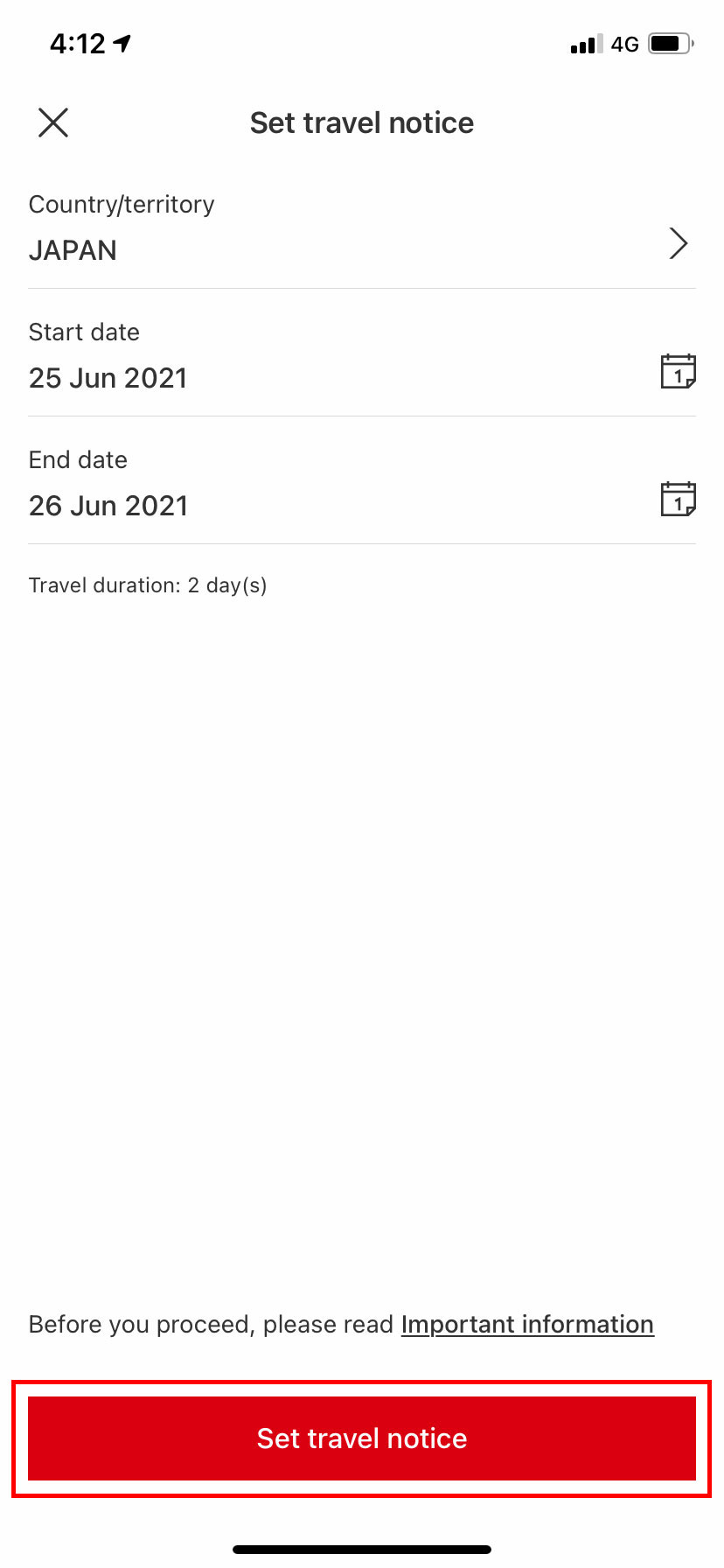

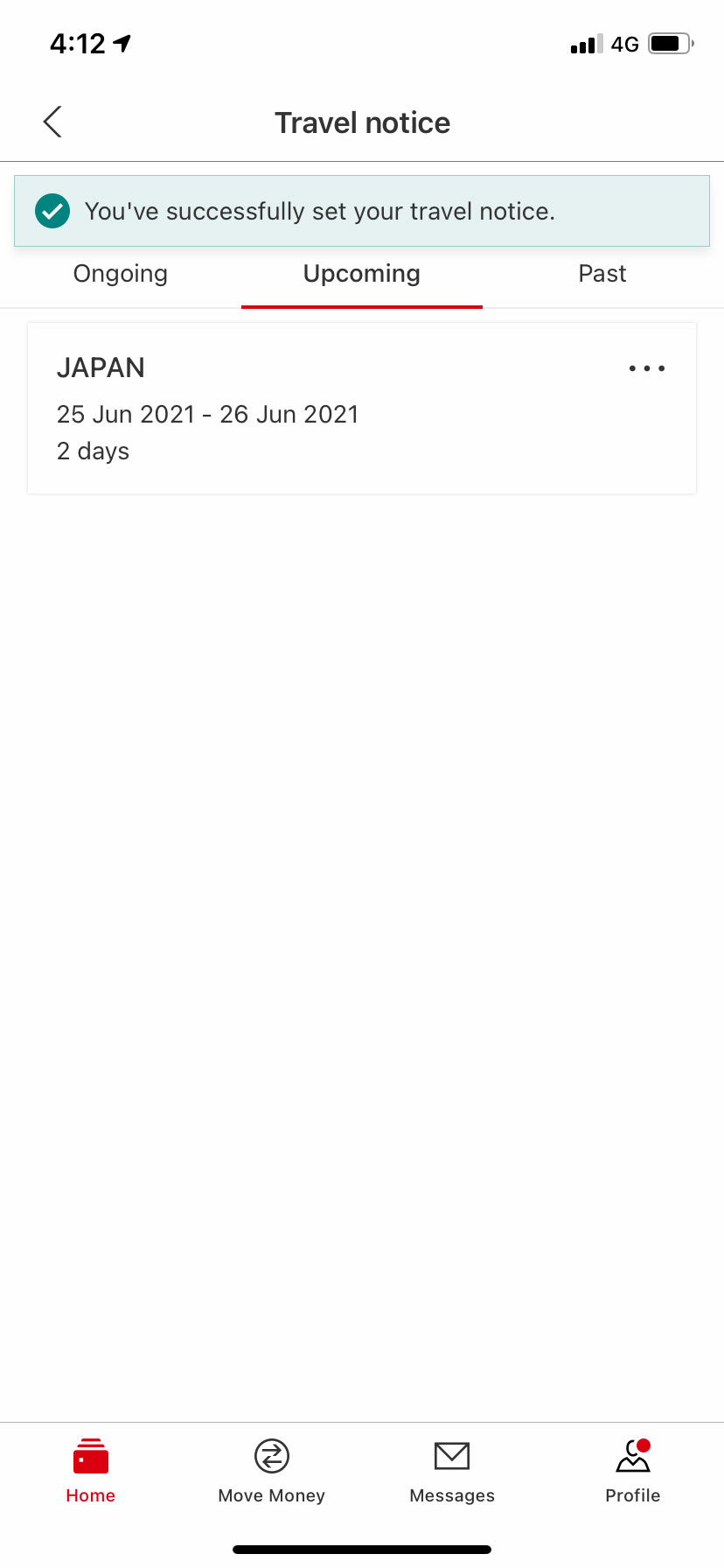

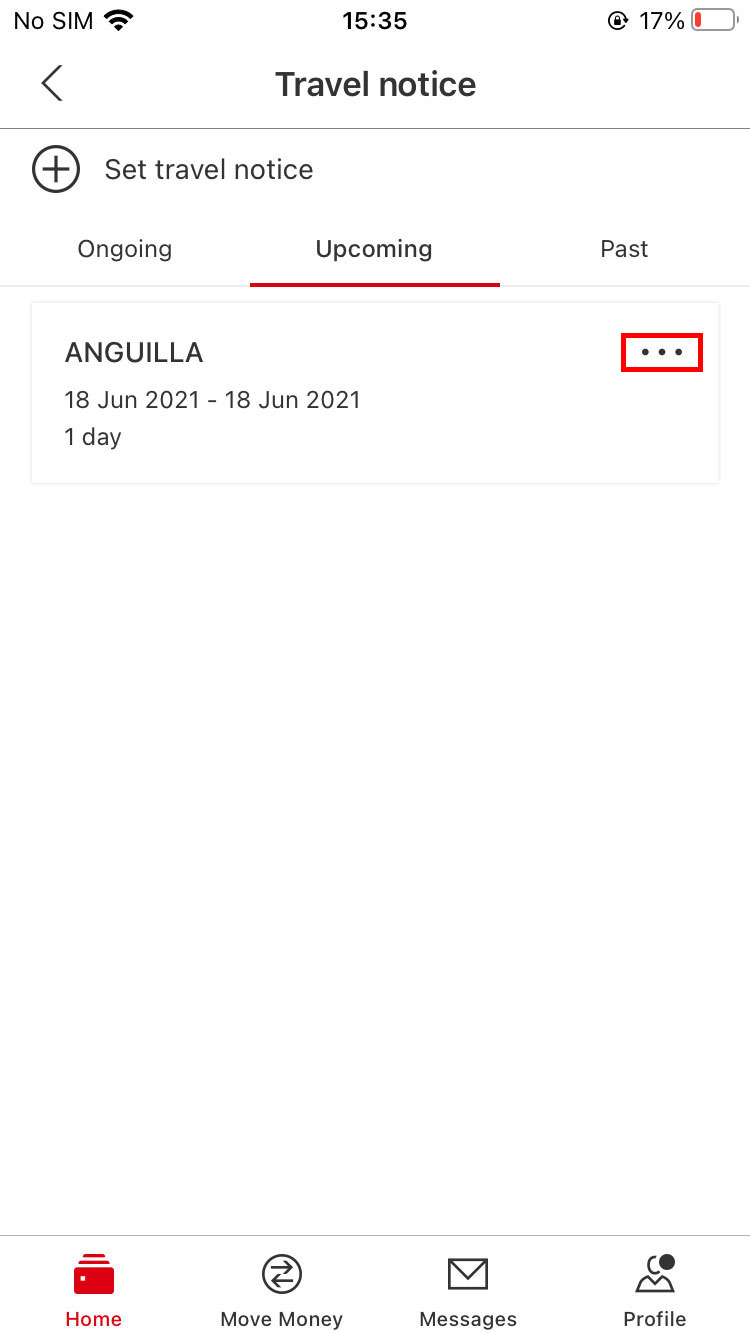

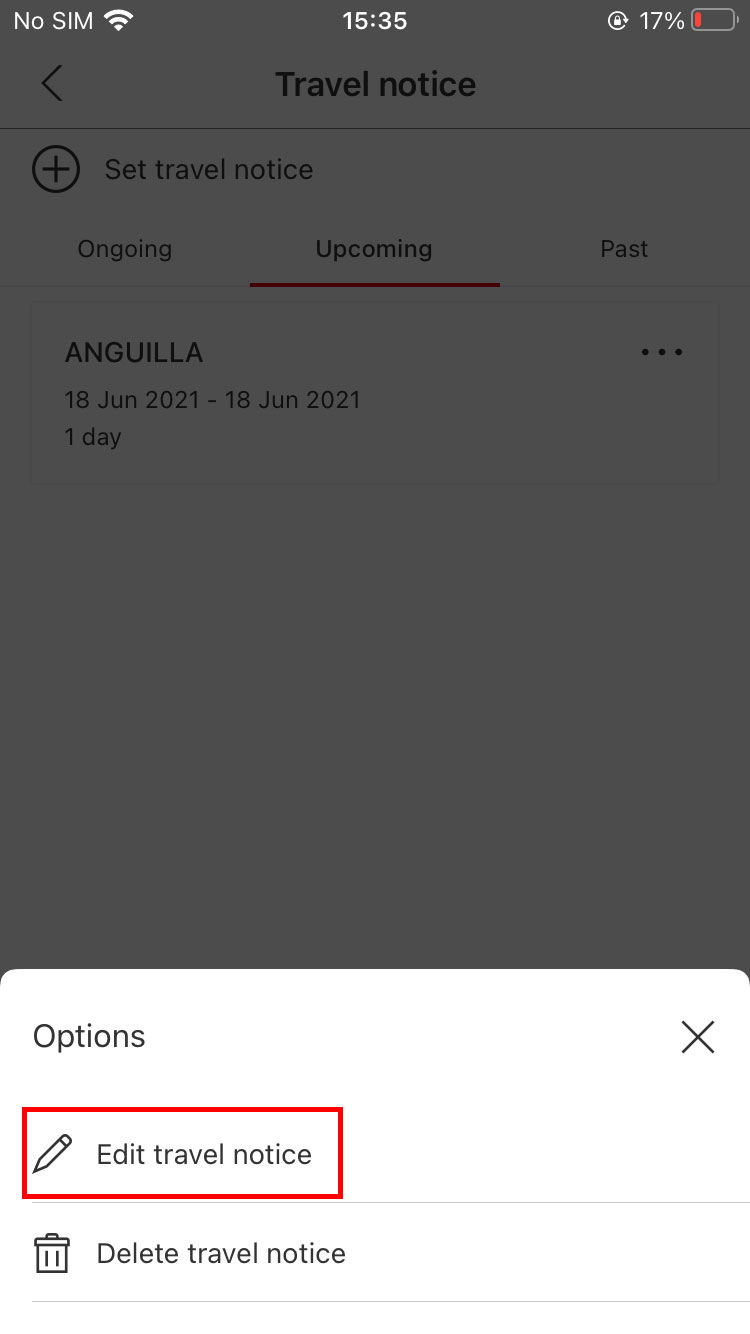

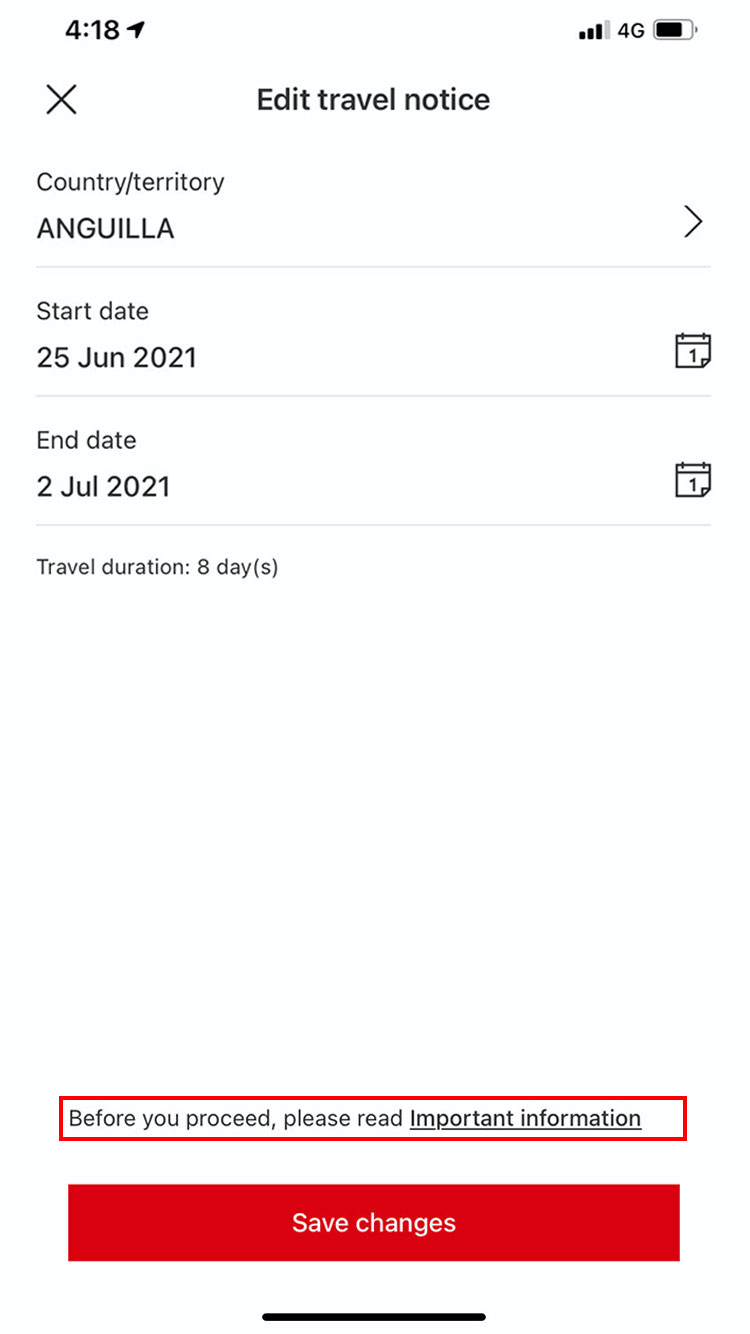

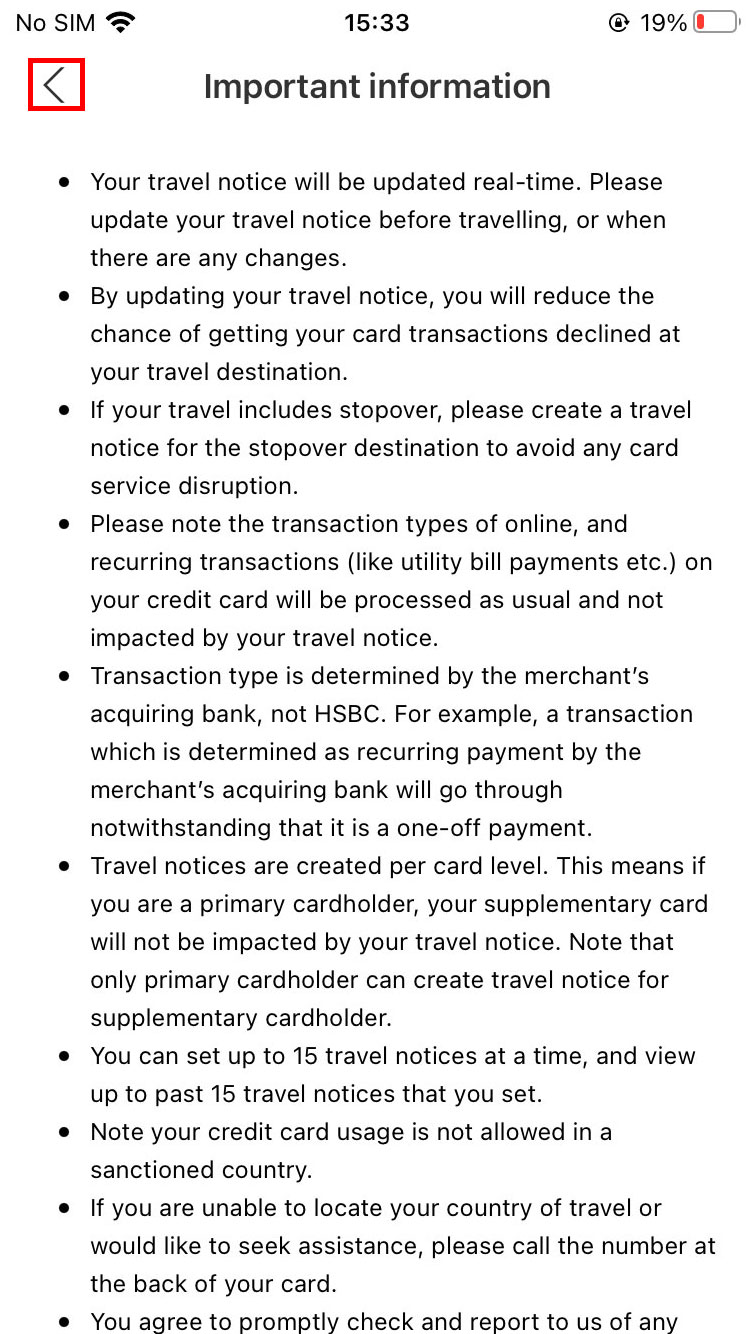

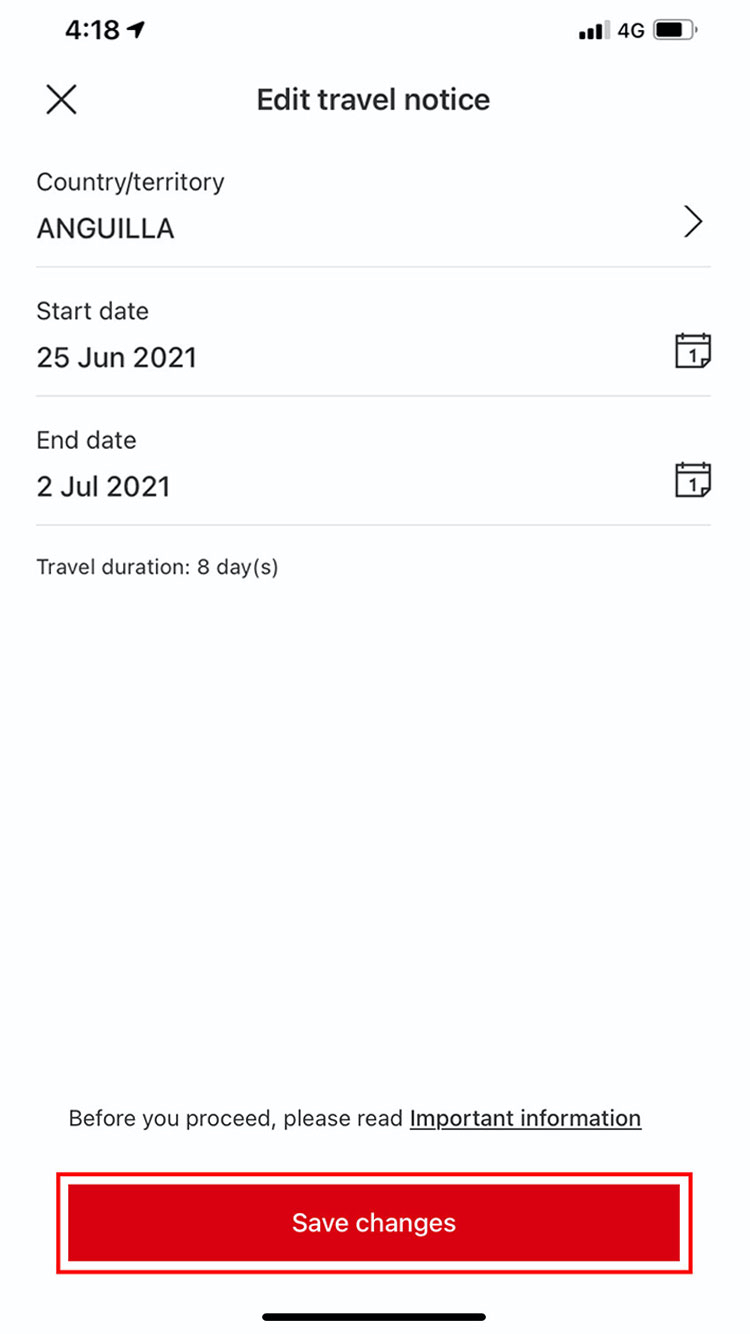

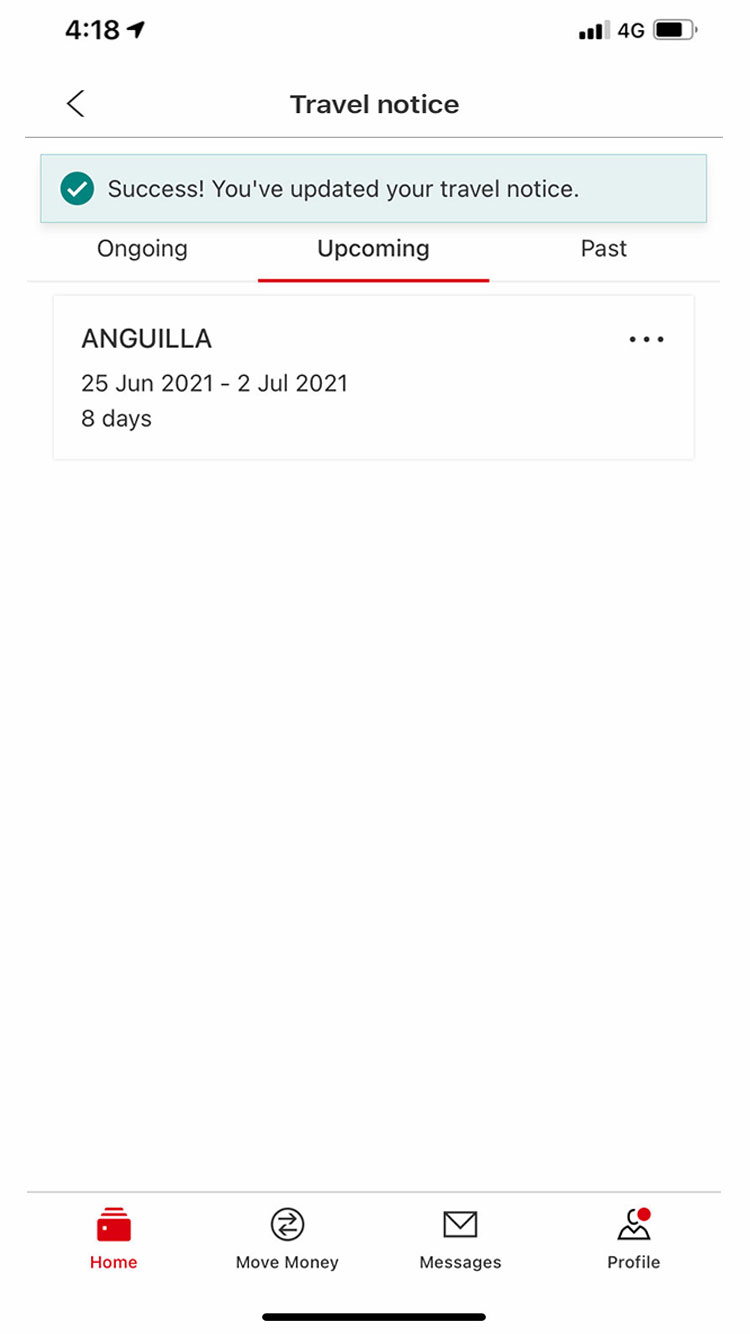

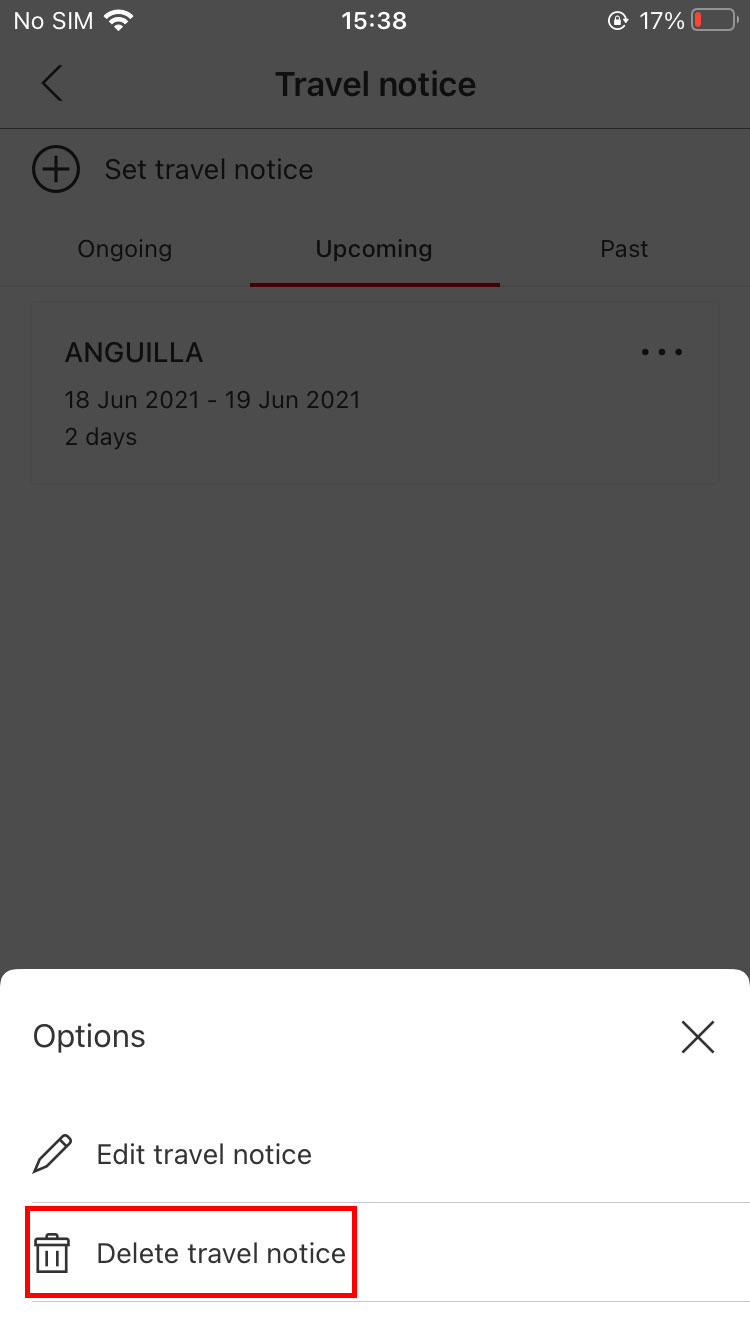

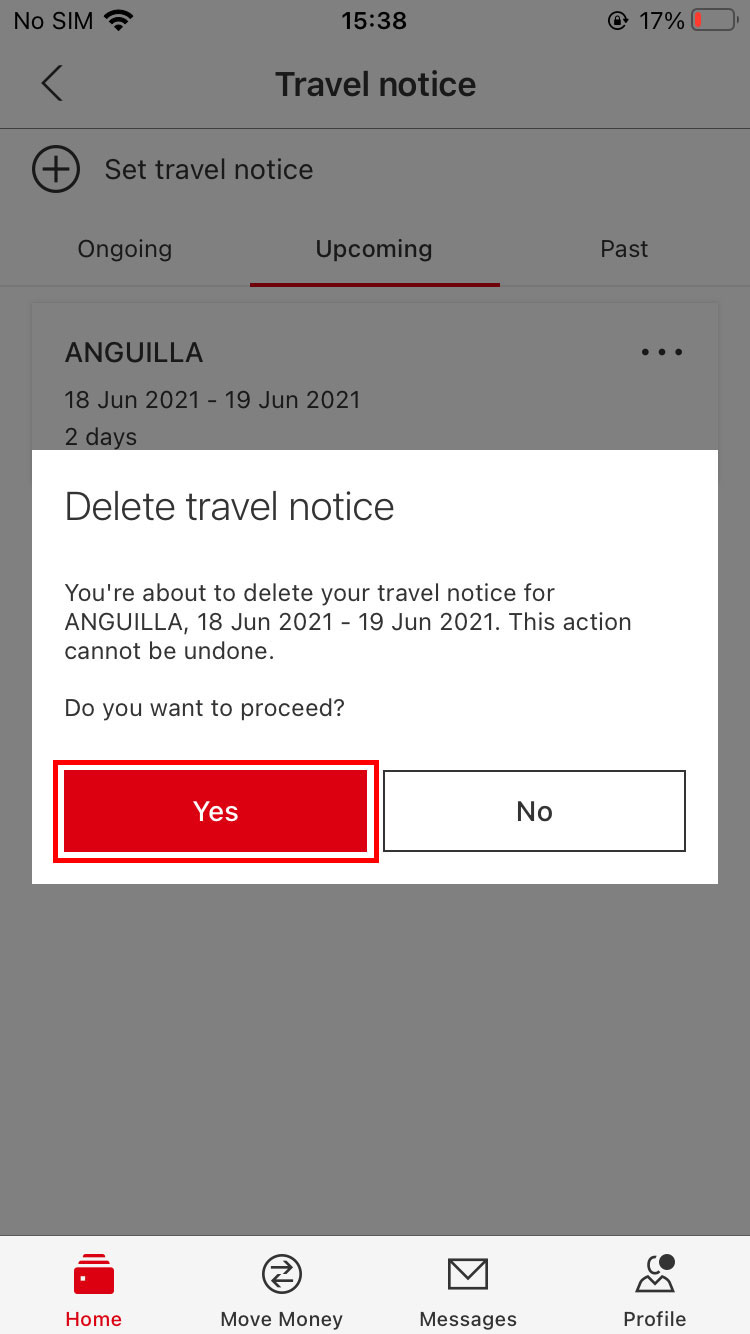

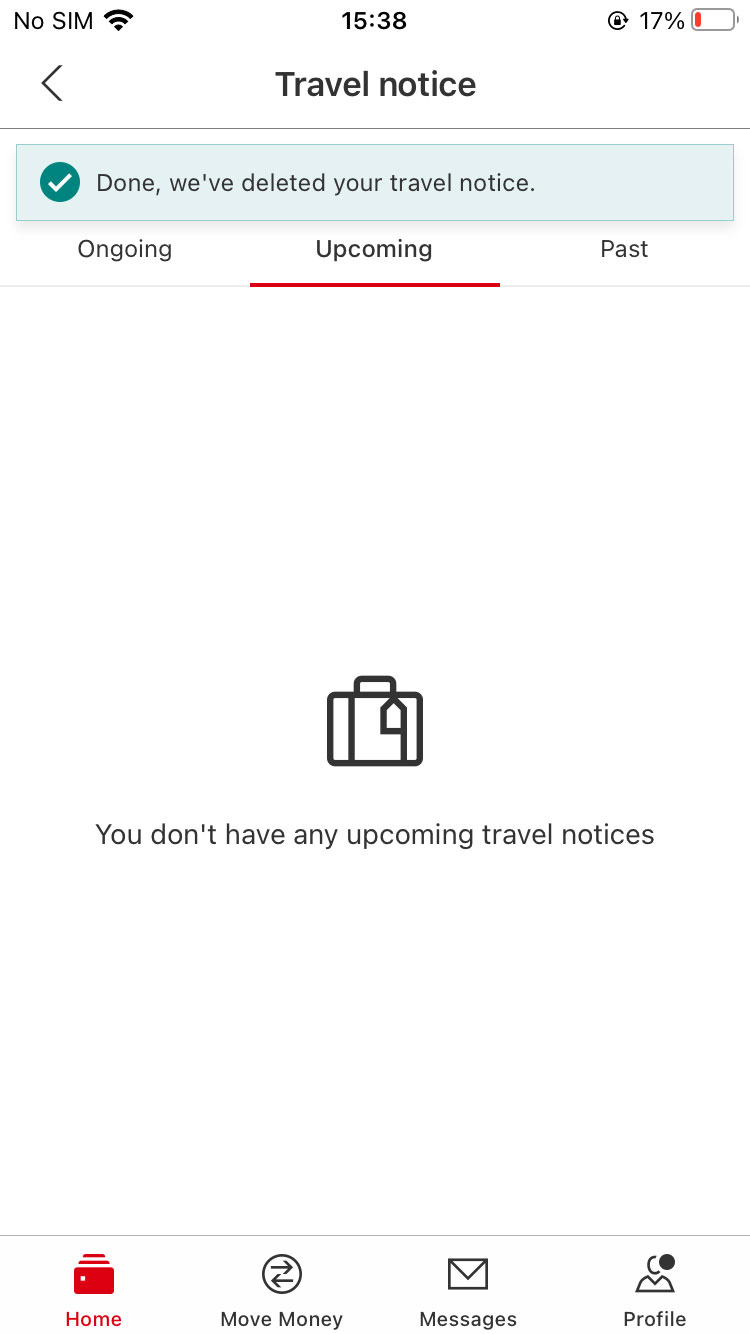

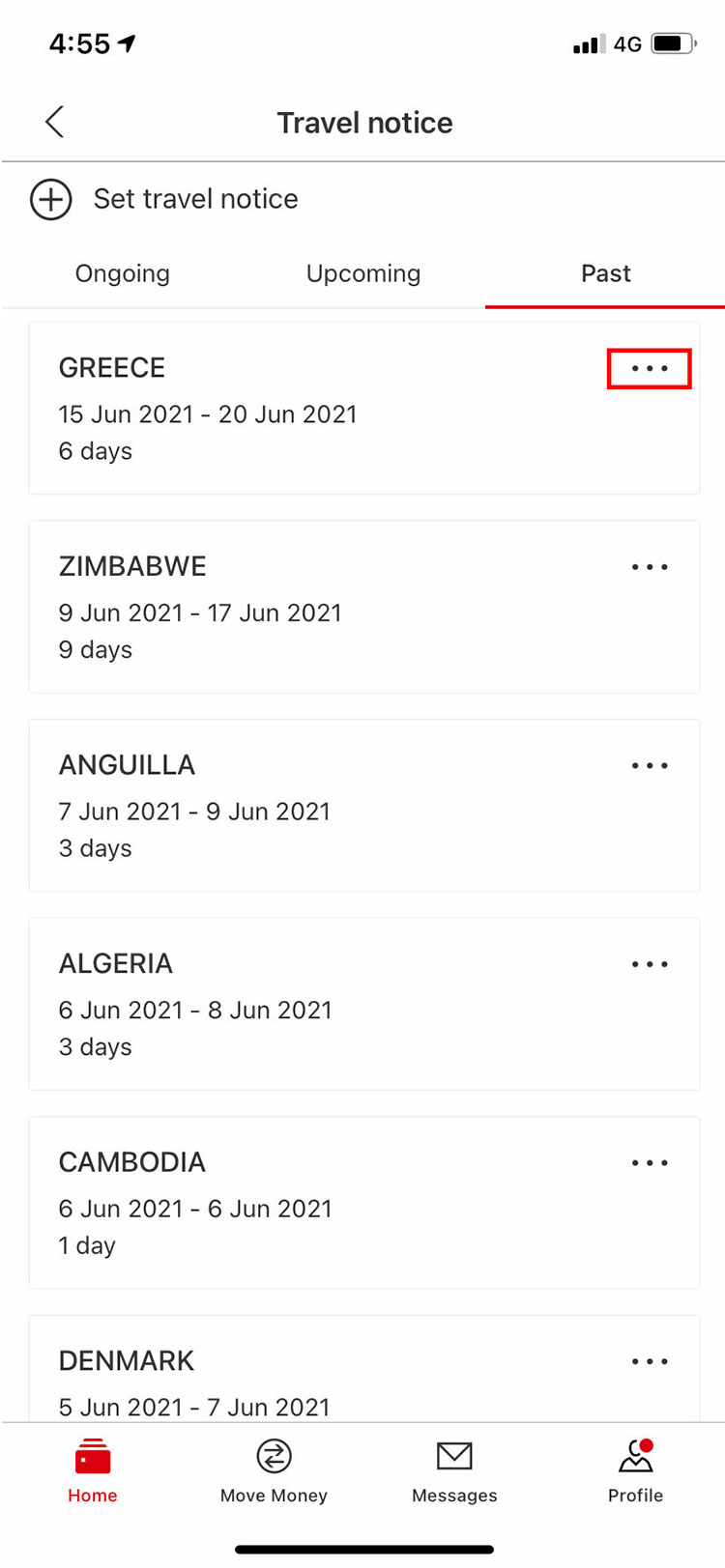

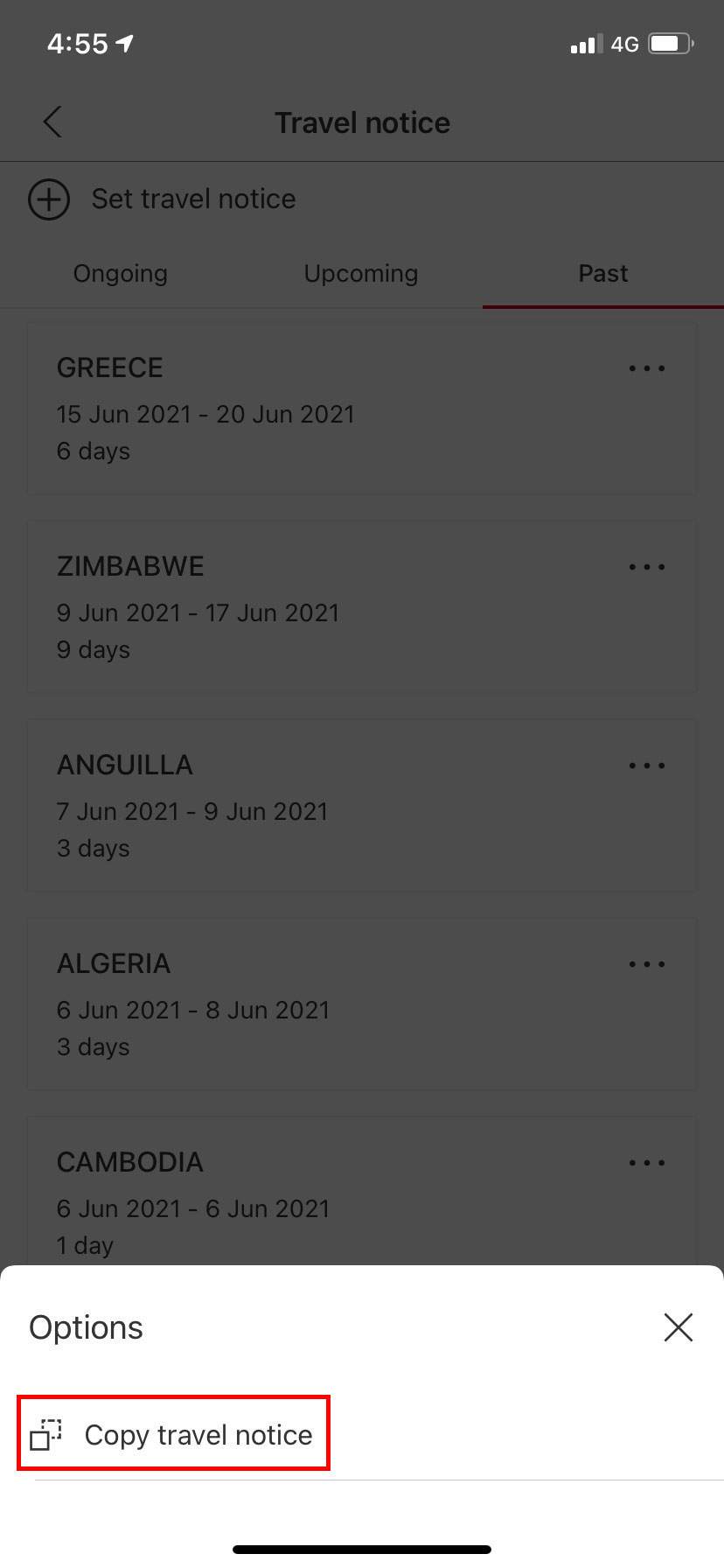

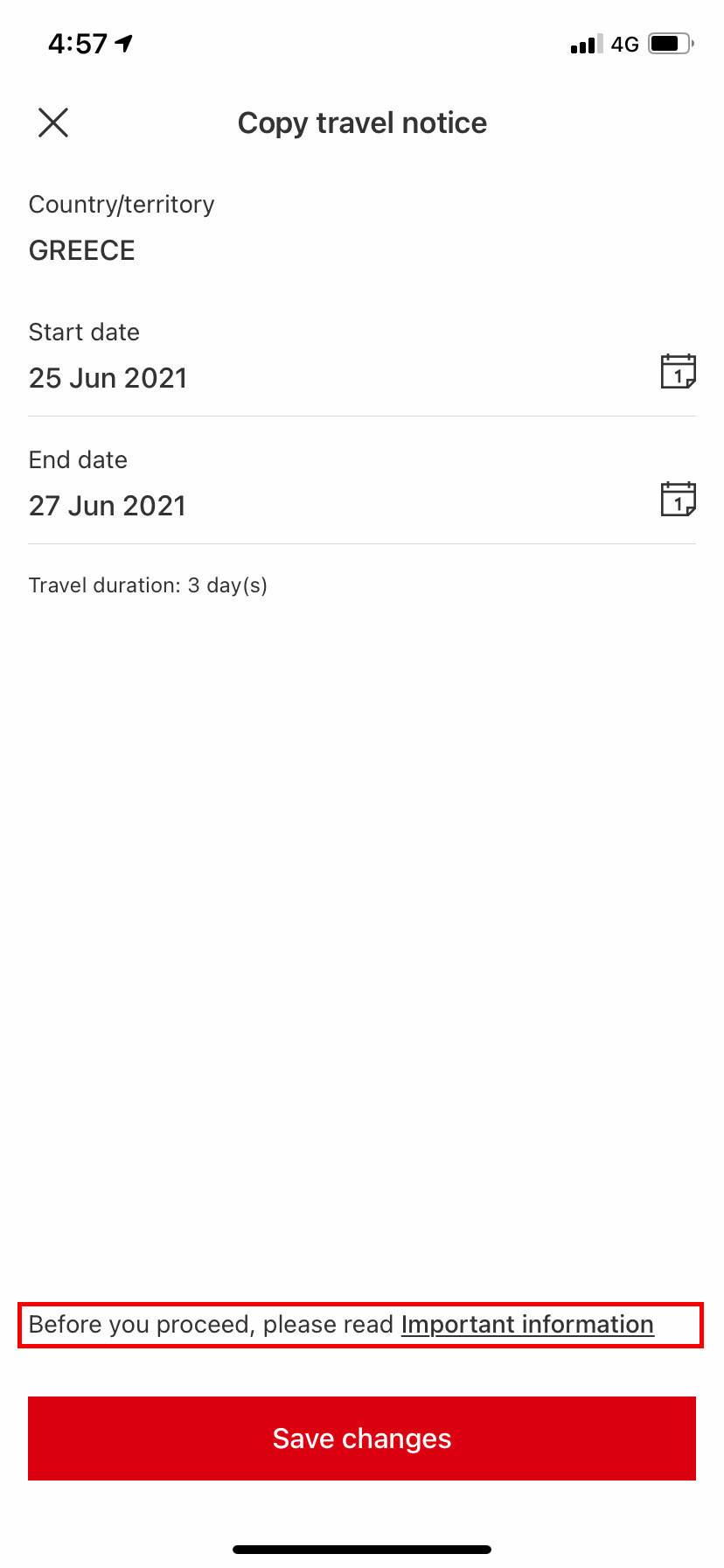

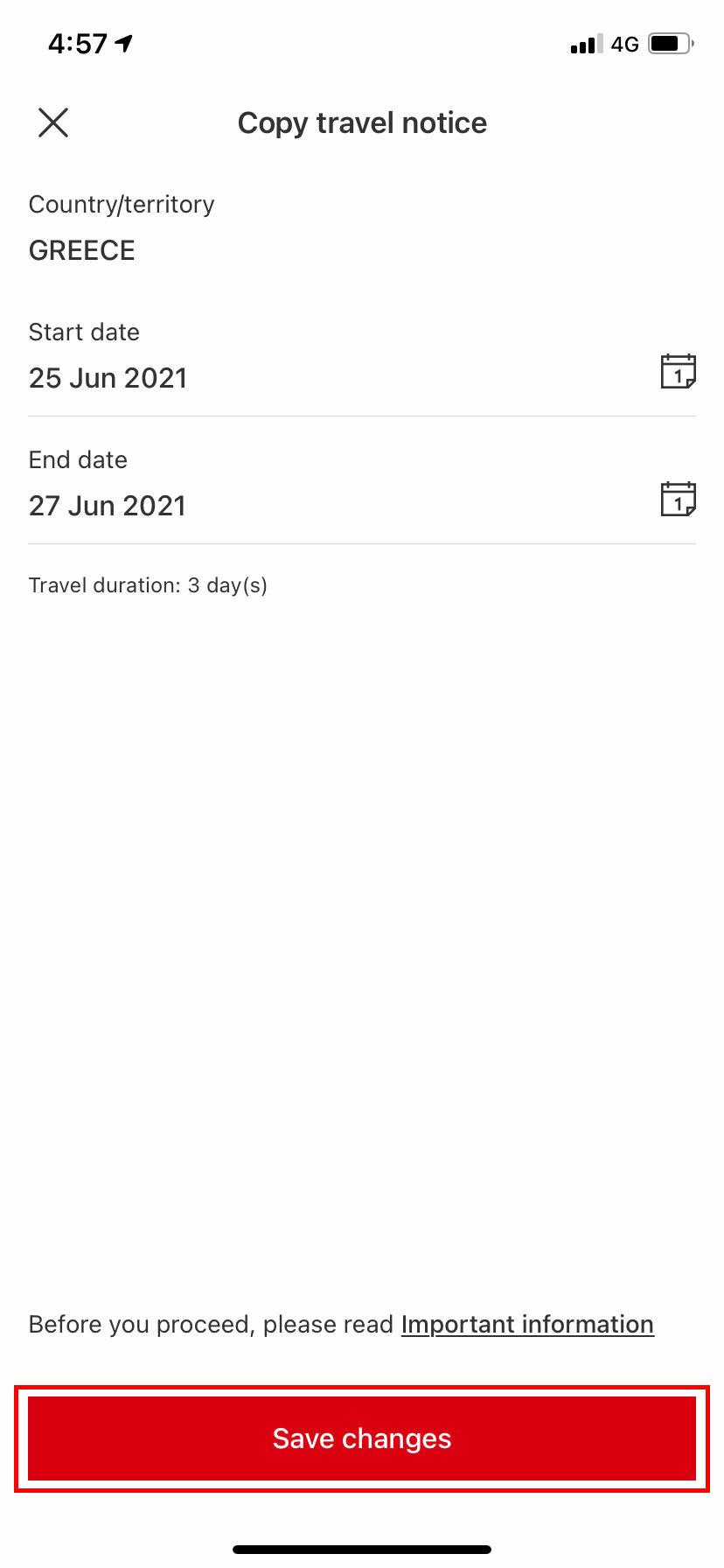

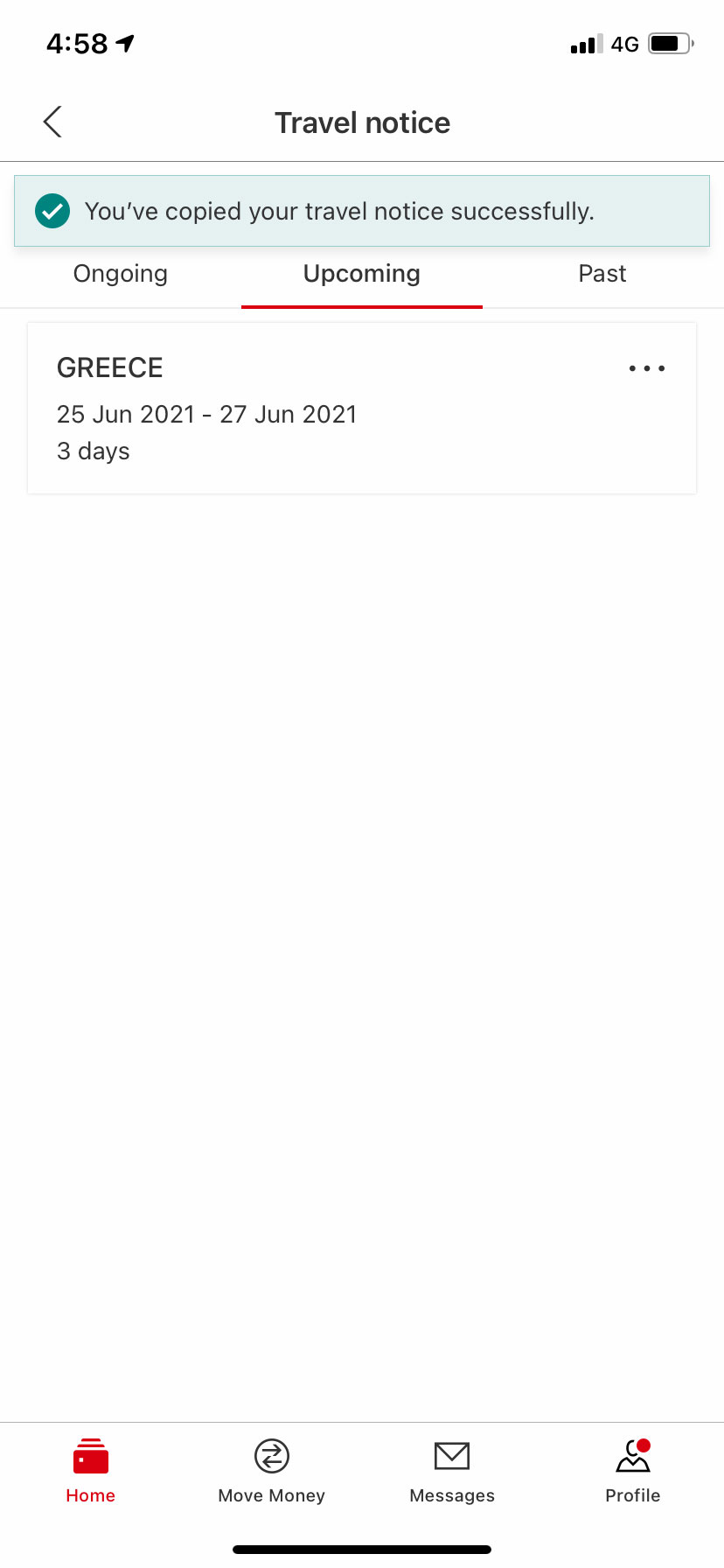

Travel Notice feature

You can now update us on your travel plans by creating a travel notice for your credit card-i. Go to the HSBC Malaysia Mobile Banking app to set one up before you embark on your trip.

Push Notifications

Effective 22 August 2023, push notifications for credit card-i statements and transaction alerts will be introduced via the HSBC Malaysia Mobile Banking app. Download our app and enable the push notification feature now. Find out more here.

Merchant Surcharge Feedback Form

What is the purpose of the merchant surcharge feedback form?

There are some merchants who are imposing extra charges on goods or services if you pay with card. Such situation would deter consumers from using card payments.

Lodging a feedback form will facilitate the merchant acquirers to take the necessary action to ensure that the merchants cease imposing surcharges or minimum purchase amount on payment card transactions, or to offer another electronic payment mode without surcharges or minimum purchase amount.

What would be the next step after raising the merchant surcharge feedback form?

The submitted form will be shared to merchant acquirers for feedback purpose only. This does not guarantee you will receive a refund of any surcharge paid to the merchant.

Cardholders who do not wish to pay the surcharge or abide by the minimum purchase amount imposed by a merchant are advised to purchase goods and services from another merchant that does not impose a surcharge or minimum purchase amount.

For avoidance of doubt, your personal data will not be shared with any third party.

Where can I locate this merchant surcharge feedback form?

You may fill up the form here. Alternatively, you may also report errant merchants to BNM by visiting https://telelink.bnm.gov.my/ to access the online form.

For further information and enquiries, please contact BNM Telelink Contact Centre at 1300-88-5465 or email to bnmtelelink@bnm.gov.my

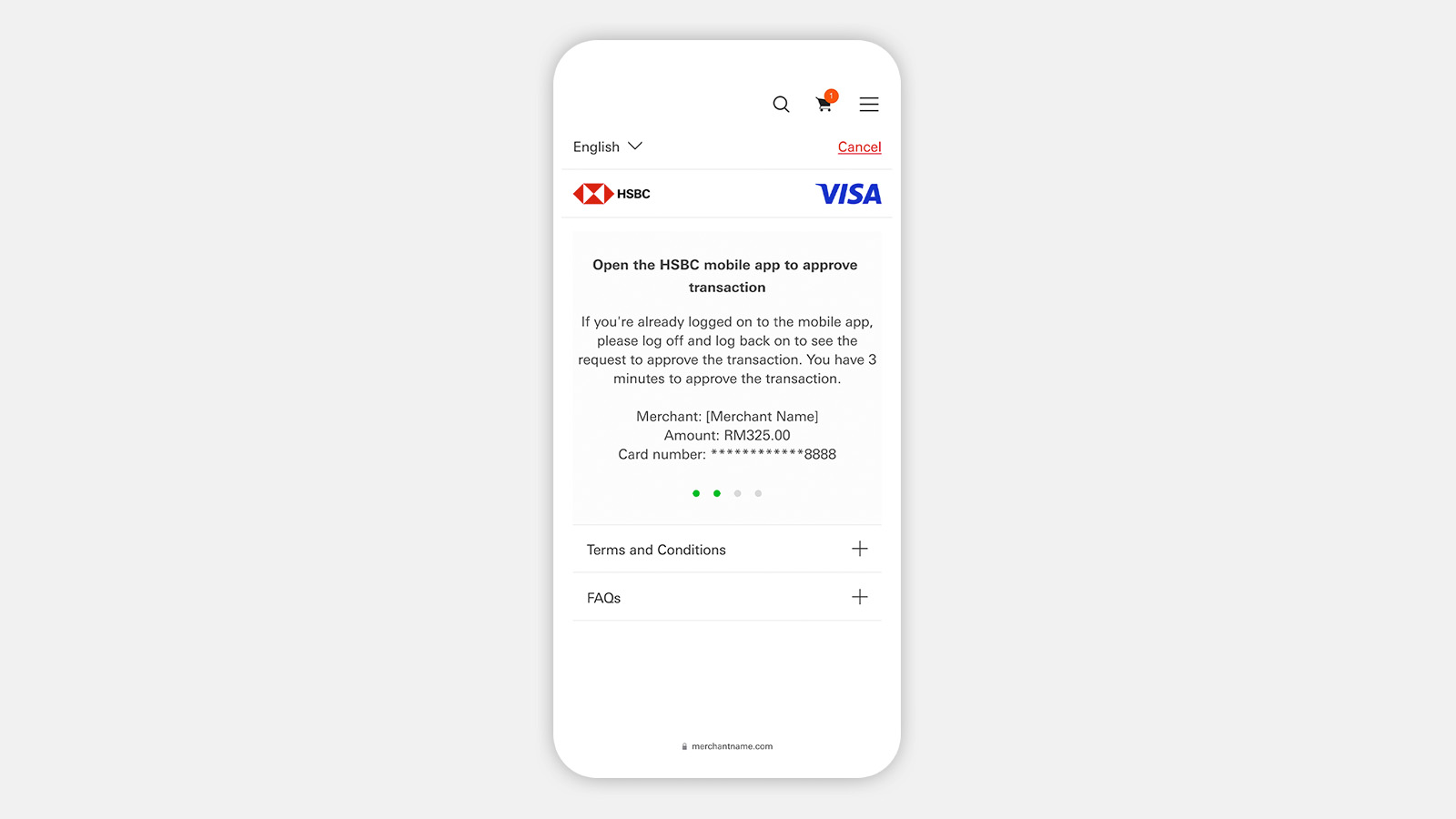

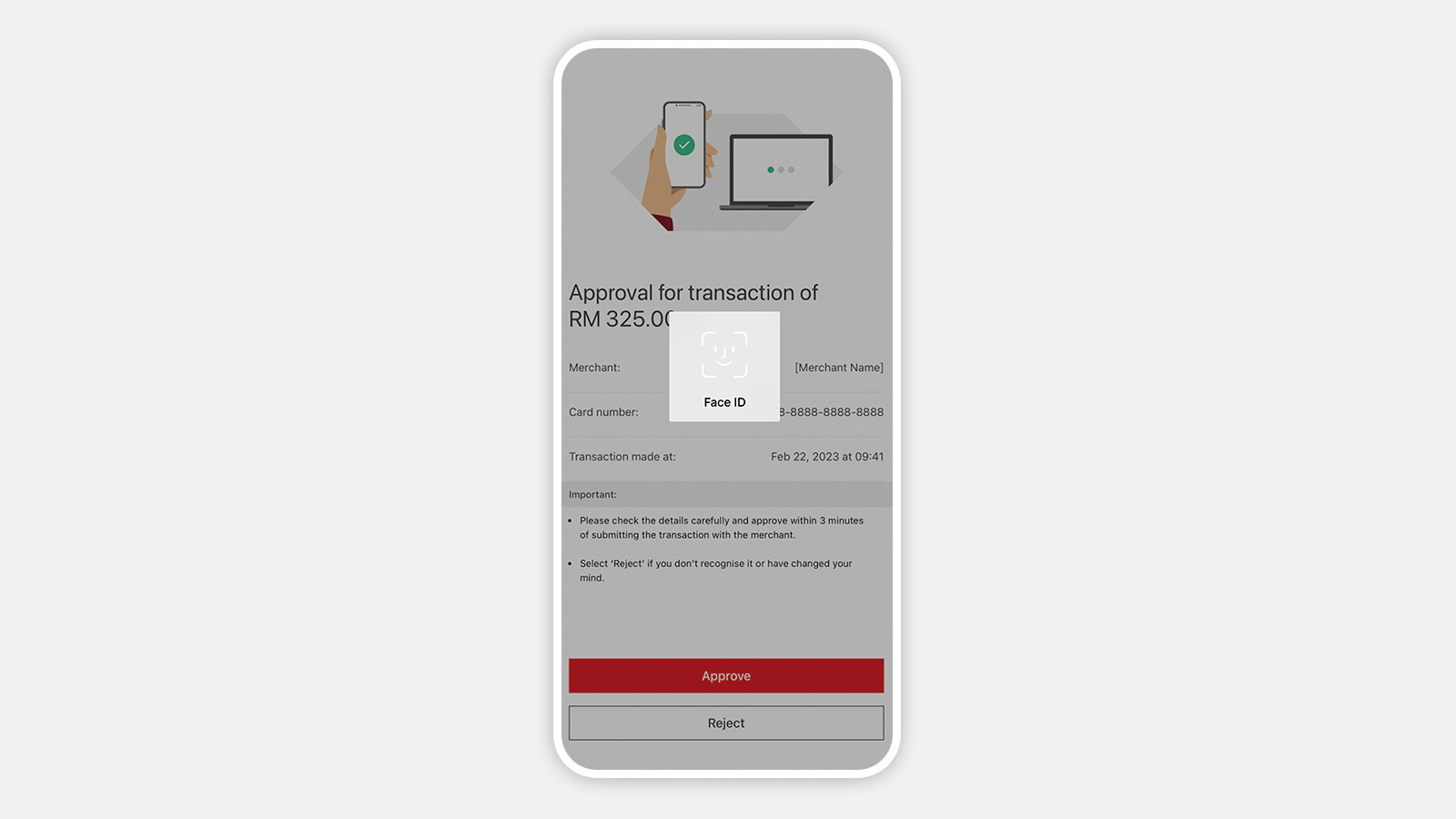

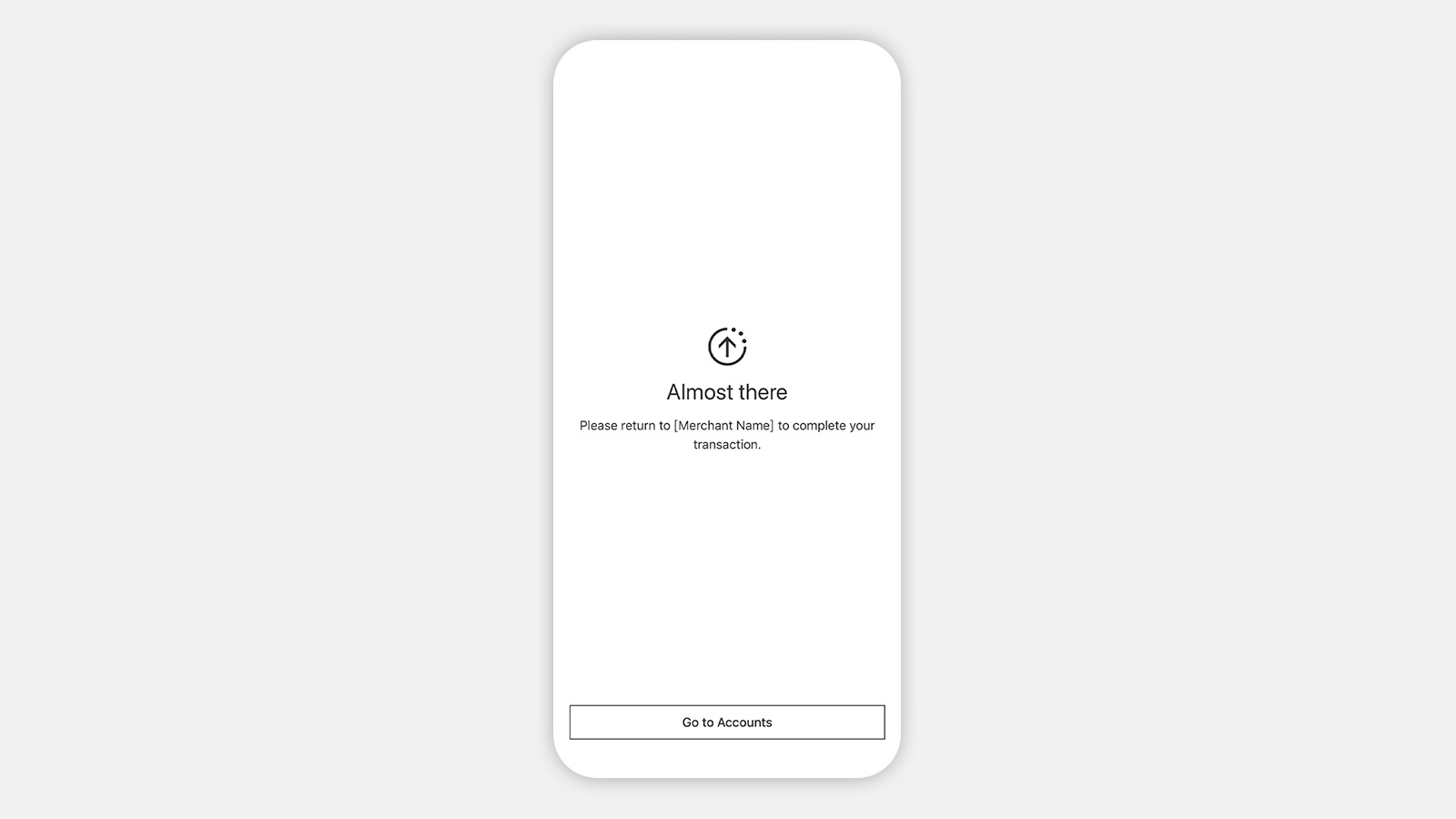

HSBC Malaysia Mobile Banking app approval for online transactions

From 21 June 2025 onwards, SMS one-time password (OTP) approval will be replaced by HSBC Malaysia Mobile Banking app approval for HSBC credit card/-i and debit card/-i online transactions.

To learn more, read our Frequently Asked Questions (PDF).