Table of contents

- What is the Wealth Dashboard / Wealth on Mobile?

- How do I access the Wealth Dashboard and Wealth on Mobile?

- How do I navigate back to the online banking summary page from the Wealth Dashboard?

- What browser and operating system will support the Wealth Dashboard?

- What functions does the Wealth Dashboard offer?

- Does the Wealth Dashboard refresh with the latest data when I click on the 'Refresh' button?

- What are the type of investment holdings available in the Wealth Dashboard and Wealth on Mobile?

- How often are the market values or prices updated?

- How is unrealised capital gain/loss calculated?

- Will I be able to transact based on the market value or the price shown on the Wealth Dashboard?

- Does the figure under the unrealised capital gain/loss reflect the exact settlement amount that I will receive after a redemption or a sale?

- How is the unit trust income distribution (dividend) recorded in both Realised and Unrealised capital gain or loss?

- Can I view my joint investment or deposits account on the Wealth Dashboard?

- Should I be concerned that I'm unable to view transaction details for my savings or current accounts on the Wealth Dashboard / Wealth on Mobile?

- Can I view the history of my investment transaction(s) on the Wealth Dashboard?

What is the Wealth Dashboard / Wealth on Mobile?

The HSBC Amanah Wealth Dashboard is a holistic online wealth platform with a simple-to-use user interface. It gives you a unified overview of your investment holdings, and also provides performance tracking and analysis, transaction history and market news and insights.

Wealth on Mobile is a section on our mobile banking app that launched in October 2021. It gives you easy access to your investment holdings, Wealth Insights and EZInvest.

How do I access the Wealth Dashboard and Wealth on Mobile?

The HSBC Amanah Wealth Dashboard is available for personal banking customers. To access it, log on to HSBC Amanah online banking and select 'Wealth Dashboard' from the menu on the left.

To access Wealth on Mobile, log on to your HSBC Mobile Banking app and tap 'Wealth' at the bottom of the page.

How do I navigate back to the online banking summary page from the Wealth Dashboard?

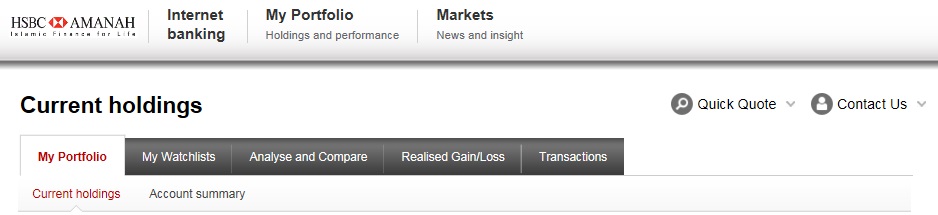

Click on 'Internet banking', which is located at the top of the webpage. You will then be directed back to the online banking summary page.

What browser and operating system will support the Wealth Dashboard?

| Operating System | Browser |

|---|---|

| Windows 7 and above | Internet Explorer Firefox Google Chrome |

| Macintosh (OSX 10 and above) | Safari |

| Operating System | Windows 7 and above |

|---|---|

| Browser |

Internet Explorer Firefox Google Chrome |

| Operating System | Macintosh (OSX 10 and above) |

| Browser |

Safari |

What functions does the Wealth Dashboard offer?

| Function | What the function offers |

|---|---|

| Portfolio view |

Allows you to view your current investment account and holdings (unit trust funds, structured investments including dual currency investment-i, Sukuk, investment linked Takaful and non-investment linked Takaful) |

| Market News and Insights |

Tailored insights of the market pertaining to your investment holdings. It channels aggregated news and information from Thomson Reuters that is relevant to your investment portfolio. |

| Analyse and Compare |

The Analyse and Compare function breaks down your investment holdings to provide an in-depth view according to underlying assets, sectors, regions and product types. |

| Top Holdings |

An interactive graphic summary of market fluctuations over time pertaining to your investments, allowing you to compare a variety of market benchmarks. |

| Watchlist |

Allows you to create a watchlist and track the performance of selected unit trust funds, bonds/Sukuk and indices. |

| Quick Quote |

Information on unit trust fund prices and foreign exchange (FX) rates. |

| Function |

Portfolio view |

|---|---|

| What the function offers |

Allows you to view your current investment account and holdings (unit trust funds, structured investments including dual currency investment-i, Sukuk, investment linked Takaful and non-investment linked Takaful) |

| Function |

Market News and Insights |

| What the function offers |

Tailored insights of the market pertaining to your investment holdings. It channels aggregated news and information from Thomson Reuters that is relevant to your investment portfolio. |

| Function |

Analyse and Compare |

| What the function offers |

The Analyse and Compare function breaks down your investment holdings to provide an in-depth view according to underlying assets, sectors, regions and product types. |

| Function |

Top Holdings |

| What the function offers |

An interactive graphic summary of market fluctuations over time pertaining to your investments, allowing you to compare a variety of market benchmarks. |

| Function |

Watchlist |

| What the function offers |

Allows you to create a watchlist and track the performance of selected unit trust funds, bonds/Sukuk and indices. |

| Function |

Quick Quote |

| What the function offers |

Information on unit trust fund prices and foreign exchange (FX) rates. |

On Wealth on Mobile, you're able to view your portfolio and Wealth Insights, and you can also access our new unit trust investment tool called EZInvest.

Does the Wealth Dashboard refresh with the latest data when I click on the 'Refresh' button?

There could be a delay in some instances as the underlying system is not refreshed immediately from the source system. Please refer to the sources and disclaimers at the bottom of the Wealth Dashboard page for details.

What are the type of investment holdings available in the Wealth Dashboard and Wealth on Mobile?

On Wealth Dashboard, you can manage unit trust funds, Sukuk, structured investments, dual currency investment-i and investment-linked Takaful / non-investment linked Takaful.

On Wealth on Mobile, you can manage unit trust funds, Sukuk, structured investments and dual currency investments-i.

How often are the market values or prices updated?

Different products have different market frequency updates:

- Unit trust funds: daily

- Sukuks (local and overseas): daily

- Structured investments: weekly

- Deposits: daily

However, the frequency of updates is also subject to batch runs and in some instances, the prices reflected are a few days delayed. Refer to the sources and disclaimers at the bottom of the Wealth Dashboard page for more details.

How is unrealised capital gain/loss calculated?

Unrealised capital gain/loss is calculated as the difference between the current market value and the book cost.

Will I be able to transact based on the market value or the price shown on the Wealth Dashboard?

All market value or prices shown on the Wealth Dashboard are indicative and should only be used as an indication of the market value for your investment holdings. Transacting in a particular wealth product would carry associated transaction costs that are specific to each product. You're advised to refer back to the corresponding product literature for details, or speak to your Relationship Manager for more information.

Does the figure under the unrealised capital gain/loss reflect the exact settlement amount that I will receive after a redemption or a sale?

The unrealised gain/loss reflects the indicative value you'll receive in the event of a redemption or sale. It doesn't factor in exchange rates and associated costs charged during an actual settlement. You're advised to refer back to the corresponding product literature for details, or speak to your Relationship Manager for more information.

How is the unit trust income distribution (dividend) recorded in both Realised and Unrealised capital gain or loss?

A unit trust dividend is not recorded in the Realised gain/loss because no cash is received and settled. However, a unit trust dividend is recorded under the Unrealised capital gain (Gain = Current Market Value X units received) in My Portfolio>>Current Holdings.

Can I view my joint investment or deposits account on the Wealth Dashboard?

Yes. Joint investment and deposit accounts are both available on the Wealth Dashboard. For Wealth on Mobile, you can view joint investment accounts, but not joint deposit accounts.

Should I be concerned that I'm unable to view transaction details for my savings or current accounts on the Wealth Dashboard / Wealth on Mobile?

No, you shouldn't be concerned.

The Wealth Dashboard displays only the latest total amount in your savings and current deposit accounts. To view the transaction details of those accounts, tap 'Internet banking' at the top of the page to go back to the account summary section.

If you're using the Wealth on Mobile and you want to view your savings or current accounts, please tap on the "Home" tab.

Can I view the history of my investment transaction(s) on the Wealth Dashboard?

Yes, going back a maximum of 2 years. If you need further analysis on your investment portfolio, please contact your Relationship Manager.

Please note that the transaction details are not available on the Wealth on Mobile. To view your transaction details, please log on to your online banking Wealth Dashboard.